Business Taxes Extension Due Date 2021

For the 2020 tax year the deadline for sole proprietors and single-member LLC tax returns filed on Schedule C with the owners personal tax return was extended to May 17 2021. If you havent applied for an extension e-file or postmark your individual tax returns by midnight.

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

Penalty and interest will not be charged if payment is made by June 1.

Business taxes extension due date 2021. 2021 Tax Due Date Update ADOR Extends Income Tax Deadline to May 17 2021 The State of Arizona has announced it has moved the deadline for filing and paying state individual income taxes from April 15 to May 17 2021. We look forward for a fair consideration on the above stated issue and once again request you to extend the due dates as stated above. You can get an additional extension to October 15 2021 by using Form 4868.

If you think you may need more time to prepare your return you should file for an extension using Form 7004. Therefore interest is charged on any taxes owed from May 17 2021 to the date the taxes are paid. The due date is moved to the next business day if it falls on a weekend or holiday.

Because the extension is limited to the 2020 taxes first quarter estimates for tax year 2021 remain due on April 15 2021. The Govt of Telangana late last evening have notified the extension of Lockdown till the end of this month. Please note that this automatic extension is not an extension of time to pay any tax owed by the regular due date of the return.

The due date for filing tax returns and making tax payments is May 17 2021. The due date for your partnership return will be extended until September 15 2021. In 2021 the IRS extended the filing deadline for 2020 individual income tax returns from April 15 to May 17 2021.

Keeping all the factors in view we humbly request you to extend the due date of Filing of Returns for the Asst year 2020-2021 to 30 th of June 2021. To conform to the automatic extensions granted through IRS Notice 2021-59 the Department will extend individual and composite State income tax returns and payments of 2020 taxes due on April 15 2021 to May 17 2021. The South Carolina Department of Revenue SCDOR is offering more time to file returns and pay taxes due April 1 2020 June 1 2020 to assist taxpayers during the COVID-19 outbreak.

This applies only to individuals including individuals who pay self-employment tax. If you want an extension you must file the extension application for a Schedule C and personal return by the tax return due date of April 15. WASHINGTON The Internal Revenue Service today reminded business taxpayers that their 2019 tax returns and tax payments as well as their first two 2020 estimated tax payments are due on Wednesday July 15.

The due date for a calendar-year partnerships 2020 return is March 15 2021. The July 15 due date generally applies to any tax return or tax payment deadline that was postponed due to COVID-19. Tax returns and payments due April 1 June 1 will now be due June 1 2020.

The 2021 Tax Filing Deadline Is Extended For Texas Oklahoma And Louisiana Residents Taxact Blog

Tax Deadline Monday 4 Reasons Why You Should File Your Income Tax Return Now Cnet

Will 2021 Tax Deadline Be Extended Again Cpa Practice Advisor

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

How To File An Extension For Taxes Form 4868 H R Block

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Tax Extension Deadline Is Today What To Know About Filing Late Irs Penalties Cnet

Tax Extension Deadline Is Today What To Know About Filing Late Irs Penalties Cnet

6 Big Ways Tax Season Will Look Different This Year Forbes Advisor

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

W 2 Deadline Penalties Extension For 2020 2021 Checkmark Blog

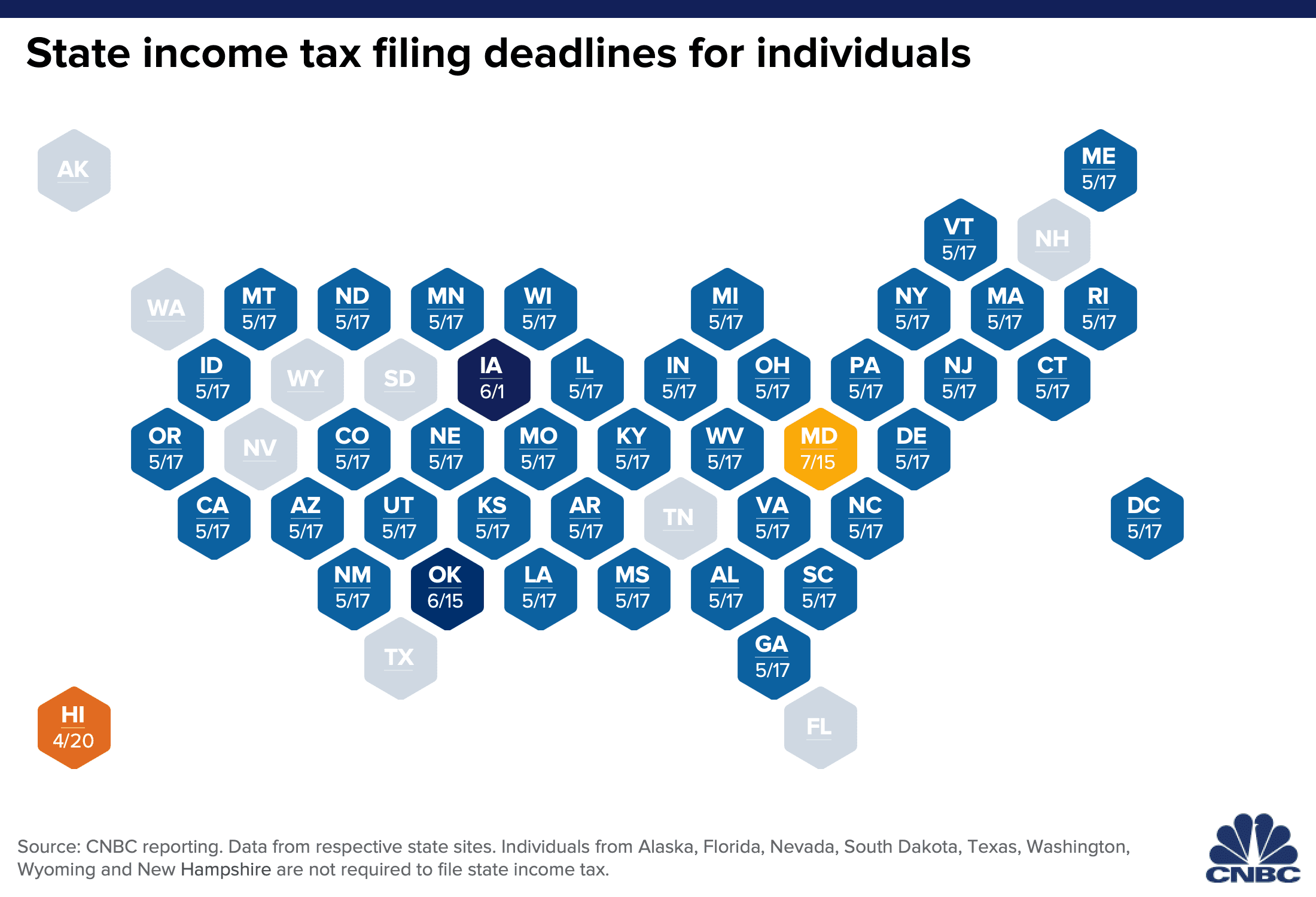

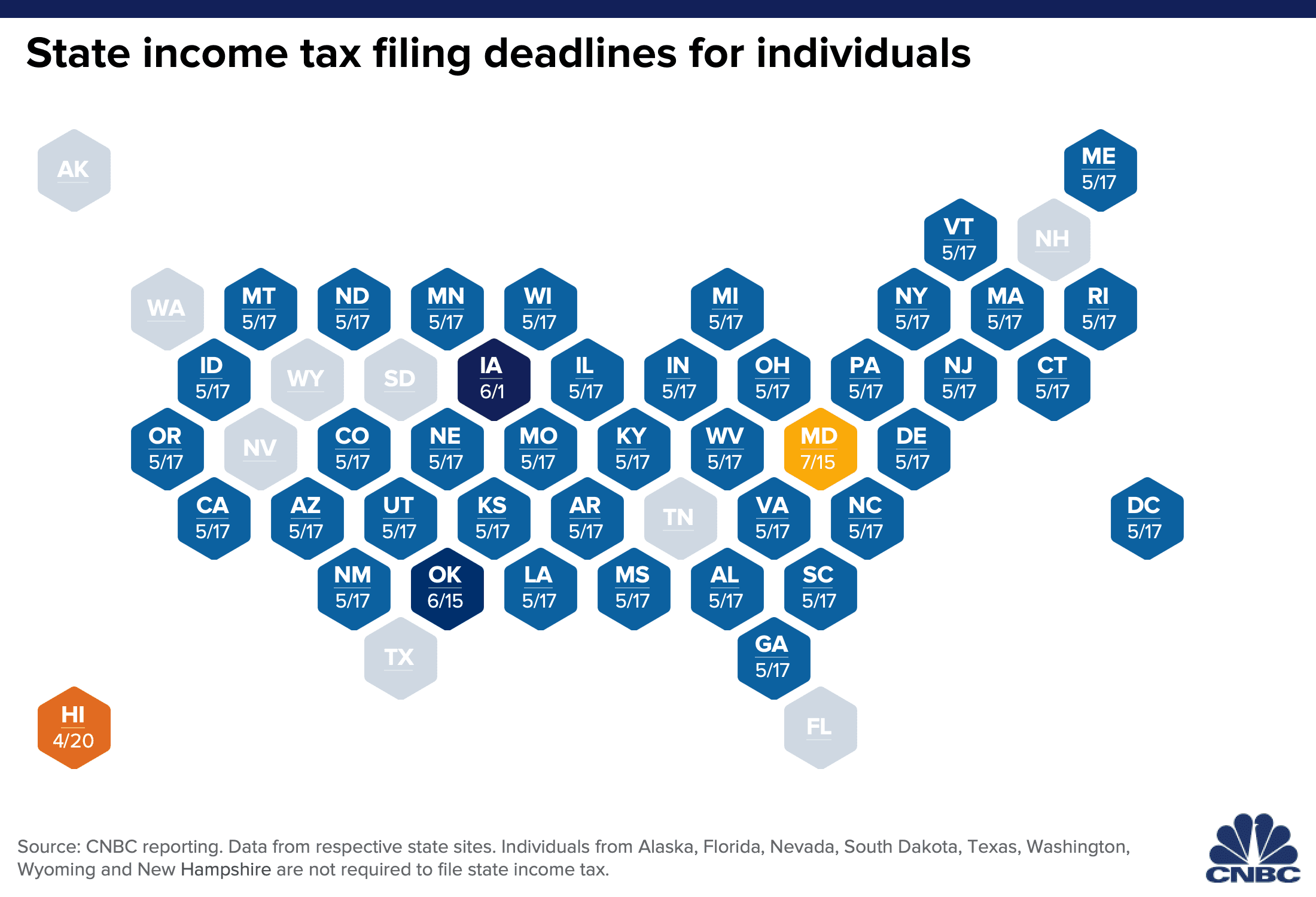

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

Https Www Revenue Pa Gov Formsandpublications Otherforms Documents Dpo 05 Pdf

W 2 Deadline Penalties Extension For 2020 2021 Checkmark Blog

Make Sure You Know Your Irs Tax Deadlines For Filing Your 2020 Business Taxes In 2021

Tax Day Irs Pushes 2020 Tax Filing And Payment Due Date From April 15 2021 To May 17 2021 6abc Philadelphia

October 15 Is The Deadline For Filing Your 2019 Tax Return On Extension

2021 Tax Due Dates For Canadians Corporate Tax Personal Tax Gst Hst Avalon Accounting

Post a Comment for "Business Taxes Extension Due Date 2021"