Gross Receipts Business License

Hospitality taxes on prepared meals food and beverages in the amount of 2 are due on the 20th of each month to Charleston County our collection agent. The petroleum business tax PBT is a privilege tax imposed on petroleum businesses operating in New York State.

Https Www Cityofventura Ca Gov Documentcenter View 11196 Business License Application Bidid

Businesses grossing between 50001 and.

Gross receipts business license. See below for tax rates. Minimal Activity Business Licenses are for businesses that gross more than 3000 but less than 10000 annually. Thus starting with Drake15 the Federal income values will not automatically flow to the New York forms.

Every person or entity engaged or intending to engage in business is required to obtain a license based on business activity and gross receipts. For all subsequent years the license is based solely on the prior year actual gross receipts. The per employee fee is 2500.

Agents determine cost by multiplying the rate for the industry type by. Gross means without deductions so gross receipts refer to the total amount of considerations received in exchange for property or services sold leased or rented during a given period before deducting costs or expenses. This license is issued after a business has complied with applicable local state and federal requirements and has paid the annual gross receipts tax applicable fees and assessments.

The location of where work is performed or out of jurisdiction payroll is a primary determinant of where gross receiptsbusiness license taxes are due. A business license is an annual regulatory permit for the privilege of conducting business within City. Since license costs vary by industry type and are based on a full calendar year new business applicants must provide an estimate for gross receipts from the beginning date of the business through December 31.

There is a non-refundable business registration fee of 8800 plus 7 in special fees for 95 total. This is due within 30 days of the business or rental start date. 10000 or under in gross receipts 0 However a license IS still required even though there is no fee 10001 - 25000 25 fee.

The PBT is imposed at a cents-per-gallon rate on petroleum products sold or used in the state. The annual registration fee is 7500. As a result certain businesses may owe less in gross receipts taxes in 2020 and future years and should consider how to account for and report out-of-jurisdiction payroll.

The tax imposition occurs at different points in the distribution chain depending on the type of petroleum product. Gross revenue is reconciled annually as the most updated tax information is reported. Gross receipts for license tax purposes shall not include any amount not derived from the exercise of the licensed privilege to engage in a business or profession in the ordinary course of business.

Your license will not be issued until the gross receipts have been received in order to determine. The minimum annual license tax is 50 for businesses with estimated gross receipts between 100000 and 1999999. Business License forms must be submitted with payment to the Finance Office for processing.

Beginning in tax year 2015 the state of New York and New York City require that gross receipts be allocated between New York State or New York City and everywhere else. The license must be renewed annually through the County Clerks office. This change was made due to mandated changes made on these forms.

The first employee is exempt. For assistance with the business license application or the licensing process please contact the Commissioners Office at 804-748-1281 or visit the office during normal business hours Monday. The current years tax is based on an estimate of gross revenue based on prior year actual gross revenue.

No annual tax return required. Businesses grossing between 10001 and 50000 pay a flat fee of 3000. Exclusions and deductions from gross receipts A.

Businesses with estimated gross receipts of 2000000 or above are assessed a percentage of their gross receipts. Businesses with gross receipts between 10000 and 300000 pay a 1000 license fee. If the municipalitys business license fees are based on gross receipts then yes you do have to report your gross receipts.

Petroleum business tax. Businesses with gross receipts over 300000 pay on a rate per 100 based on the particular business classification. If the registration is filed later than 30 days after the business start date penalty plus interest for each month beyond the 30 days will be added.

To obtain the annual license remit an application along with 15 to the County Clerks office. Businesses having less than 10000 in gross receipts owe no tax. Business license fees are due prior to commencing operations and annually on July 31.

In order to obtain a business license you must view the categories below group classifications and must have your estimated gross receipts for a new business. The business license tax fee is based primarily on. Except for a few exceptions gross receipts of a business encompass all business activities that generate income.

Business license taxes are usually based on a businesss previous years gross receipts. Do I have to report my gross receipts. Starting in 2006 the City of Harrisonburg is employing a tier system for gross receipts 50000 and less.

Renewal Notice Instructions Finance Department City Of Santa Monica

The Seattle Business License Tax Is Applied To The Gross Revenue That Businesses Earn It Is Sometimes Called The Seattle Busine Financial Advice Business Tax

Santa Barbara Current Business License Change Renewal

Http Revds Com Taxpayerpdfs Alabama Taxpayerforms Fee 20schedule Vernon 20business 20license 20fee 20schedule Pdf

Guide To Online Renewals Finance Department City Of Santa Monica

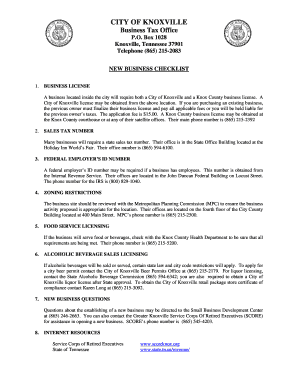

City Of Knoxville Business License Fill Online Printable Fillable Blank Pdffiller

Https Www Menlopark Org Documentcenter View 1487 Business License Instructions Non Local

City Of Oakland Business License Financeviewer

Http Www Cityofsalinas Org Sites Default Files Services Finance Pdf Busincesslicenseinfo Pdf

Which Business Expenses Are Tax Deductible Business Expenses That Are Tax Deductible Are Car And Truck Expenses Paymen Income Statement Balance Sheet Income

Http Www Richlandcountysc Gov Portals 0 Departments Bsc Documents Bl Instructions Renewing Online Pdf

Https Www Kingwilliamcounty Us Documentcenter View 128 King William County Business License Application Pdf

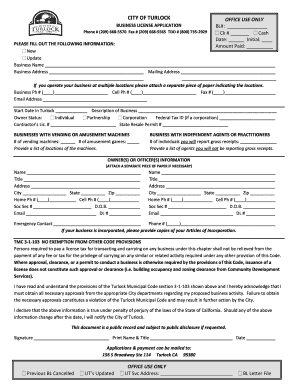

City Of Turlock Business License Renewal Fill Online Printable Fillable Blank Pdffiller

Https Www Chesterfield Gov Documentcenter View 7130 2019 Application For Business License Pdf

Http Revds Com Taxpayerpdfs Alabama Taxpayerforms Fee 20schedule Mcintosh 20business 20license 20fee 20schedule Pdf

Editorial Haven T Renewed Your County Business License Yet It Could Cost You Hundreds Of Dollars Decaturish Locally Sourced News

Santa Barbara Business License Tax Application

Post a Comment for "Gross Receipts Business License"