Average Small Business Loss First Year

The average yearly income and salary for a cleaning business will depend on the stage your business is in. Especially since youll be going into your 2nd year of business in a few days.

The Fed Availability Of Credit To Small Businesses September 2017

The basic idea is that if you conduct more than 50 of your business from home you are allowed to claim many different business costs such as rent mortgage.

Average small business loss first year. If your business claims a net loss for too many years or fails to meet other requirements the IRS may classify it as a hobby which would prevent you from claiming a loss related to the business. Most small businesses pay their business income tax through their personal tax return. Pass-Through Businesses.

Sole proprietors and one-owner LLCs complete a Schedule C - Profit and Loss for Business as part of the owners Form 1040. According to data from the US. Many large corporations manage to develop and grow without showing a profit for several years.

Even with a low start-up cost business you will eventually need to invest money into your business in order to grow it by expanding products services moving into new geographic territories or. Average Revenue by Employee Size Small to Medium Size Business. So for our first year in business we are claiming a business loss.

And then theres the reality that 25 percent of new businesses fail in their first year according to the Small Business Administration. In other words what percentage of dollars does the average small business put in its pocket every year. The general answer to how long a business can show a loss is as long as it actually has a loss.

In the beginning your business can range from 30000 to 50000 a year as you start to secure clients. After 10 years only around a third of businesses have survived. You determine a business loss for the year by listing your business income and expenses on IRS Schedule C.

But I do have some advice Id like to offer that may make future years even easier and simpler for you. The business startup deduction can be claimed in the tax year the business became active. Namely it means you personally own a business and its assets.

By the end of their fifth year roughly 50 have faltered. If your costs exceed your income you have a deductible business loss. I extracted the data into the following chart.

The IRS says you can file an amended tax return for 2018 andor 2019 if your business losses. They asked 1003 people the general public what they believed the average profit margin was for a small business. Once youve hired additional cleaners you can make from 50000 to 70000.

Reason-Rupe did a study in 2013. However this question typically relates more to small businesses and the difference between a true business loss and a hobby that costs money to manage. Small businesses fail within the first year.

If the IRS classifies your business as a hobby youll have to prove that you had a valid profit motive if you want to claim those deductions. However if you anticipate showing a loss for the first few years consider amortizing the deductions to. The main aspect of these deductions that I was not aware of was all of the home expenses that we are able to deduct.

The average small business revenue with no employees is 44000 per year and the average revenue of a small business with employees is 49 million in 2021. The fact youre showing a loss your first year is common and expected. That is there are no limits to how much business loss you can take for the year.

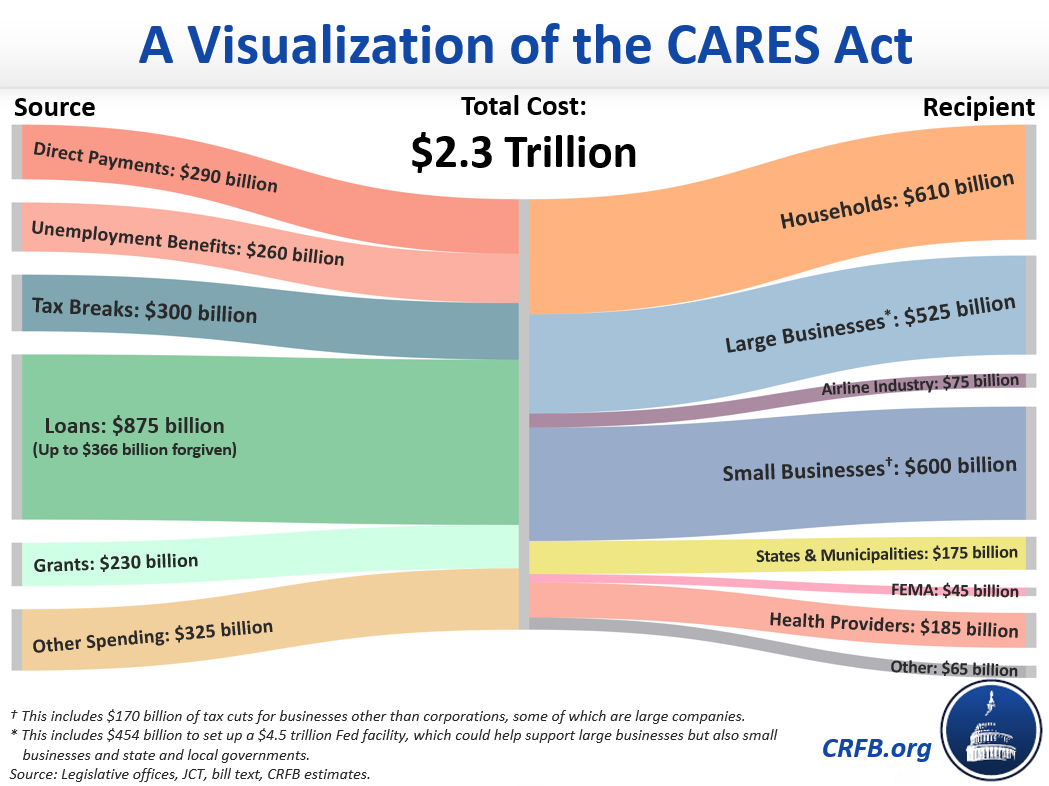

Bureau of Labor Statistics about 20 of US. You deduct such a loss on Form 1040 against any other income you have such as salary or investment income. The CARES Act removed the limit on business losses for small businesses not corporations.

The above average small business revenue addresses the revenue question. Even companies that turn a profit may lose it in their first year when they invest back in their business by hiring new people or expanding their product or service offerings. Few small businesses make much profit their first year - if they make any profit at all.

The Fed Availability Of Credit To Small Businesses September 2017

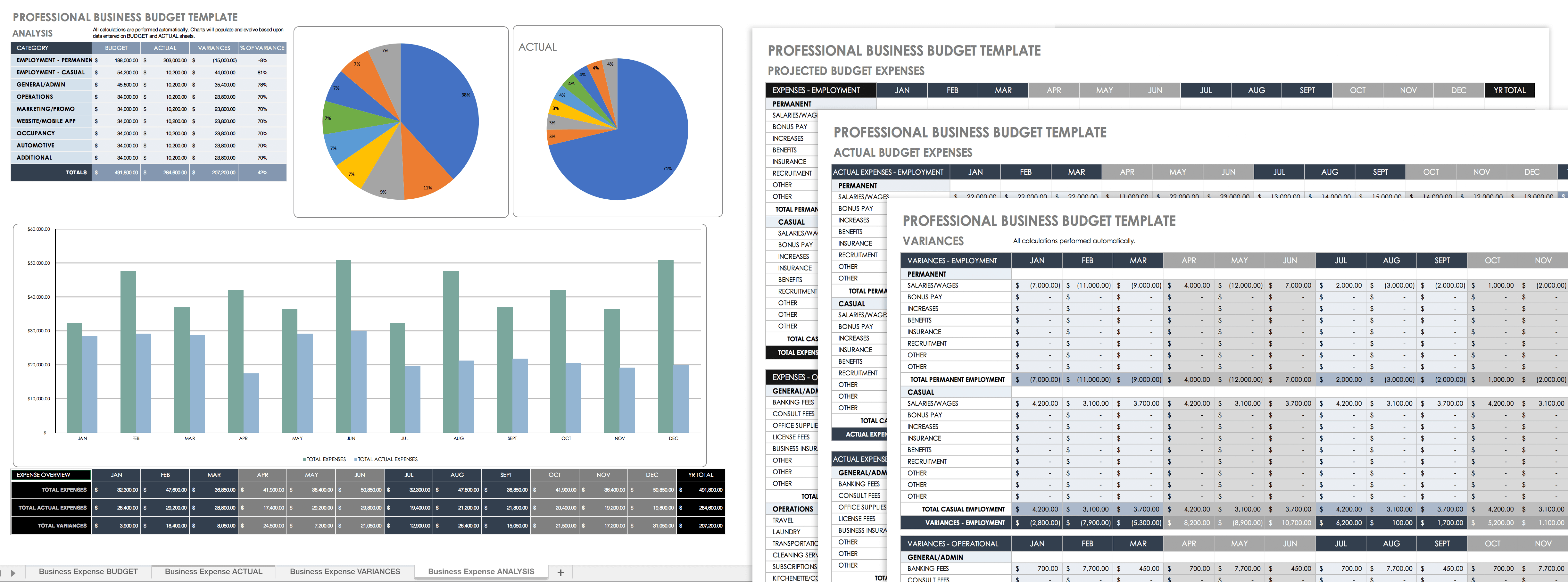

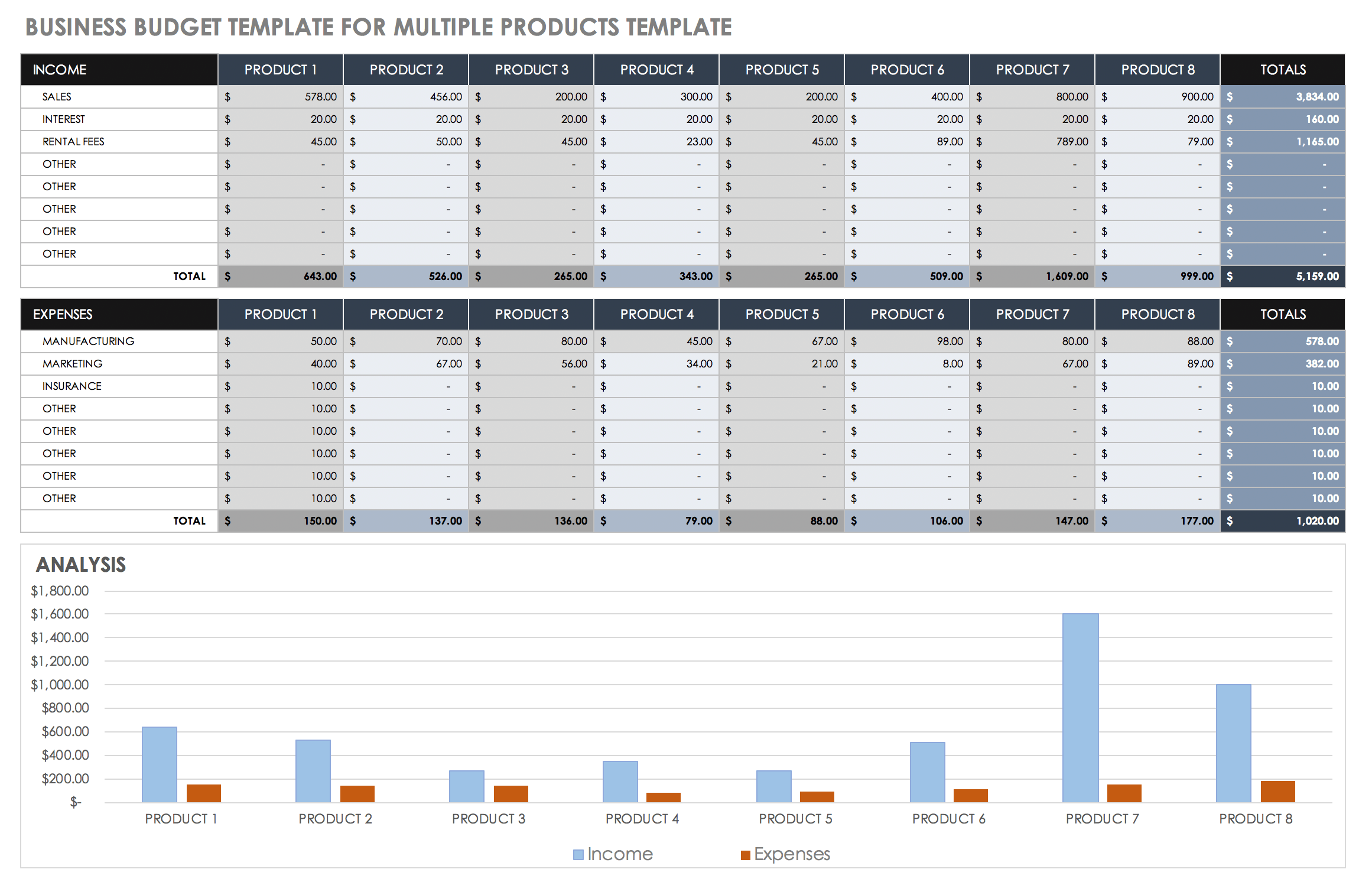

Free Small Business Budget Templates Smartsheet

The Fed Availability Of Credit To Small Businesses September 2017

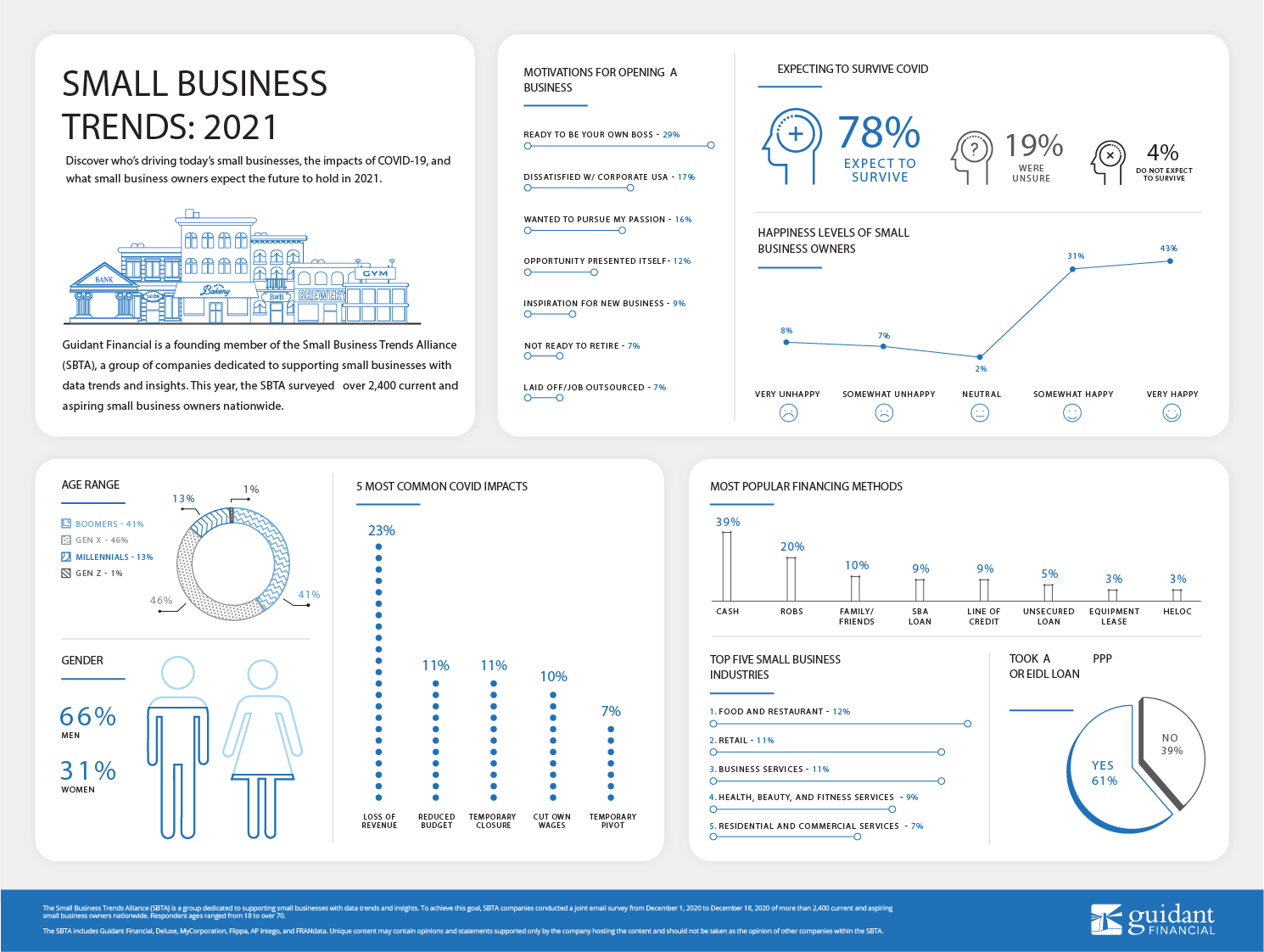

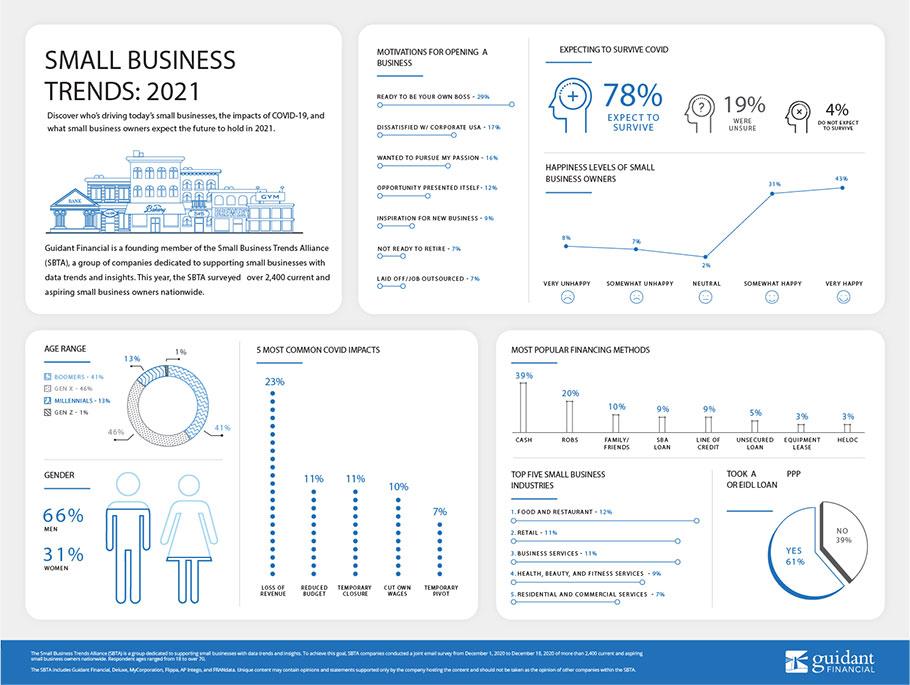

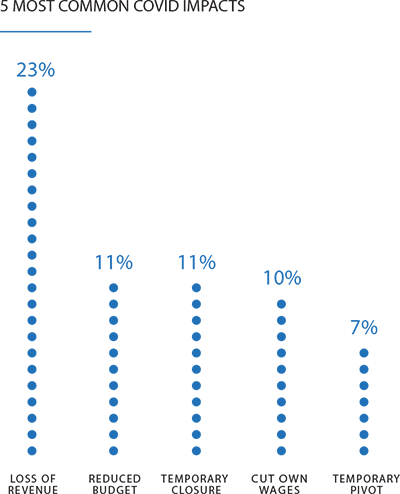

2021 Small Business Trends Statistics Guidant Financial

Free Small Business Budget Templates Smartsheet

Is Your Company Profitable 5 Simple Steps To Check Your Numbers

The Fed Availability Of Credit To Small Businesses September 2017

2021 Small Business Trends Statistics Guidant Financial

Main Street S Workers Families And Small Businesses Are Now Suffering As Wall Street Prospers From Policies To Fight The Coronavirus Recession Equitable Growth

The Fed Availability Of Credit To Small Businesses September 2017

2021 Small Business Trends Statistics Guidant Financial

Main Street S Workers Families And Small Businesses Are Now Suffering As Wall Street Prospers From Policies To Fight The Coronavirus Recession Equitable Growth

Main Street S Workers Families And Small Businesses Are Now Suffering As Wall Street Prospers From Policies To Fight The Coronavirus Recession Equitable Growth

The Fed Availability Of Credit To Small Businesses September 2017

Main Street S Workers Families And Small Businesses Are Now Suffering As Wall Street Prospers From Policies To Fight The Coronavirus Recession Equitable Growth

The Fed Availability Of Credit To Small Businesses September 2017

Coronavirus Response Page At Laedc 2021 Los Angeles County Economic Development Corporation

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Post a Comment for "Average Small Business Loss First Year"