Business Valuation 3 X Profit

If the standard valuation for this industry is 3 times net profit the business value will be 150000. Depending on how many of the above boxes your business checks and most importantly how large the business is construction companies will sell for 1 45 X annual profit.

Business Income Statement Template Inspirational What Goes In Eent Sample For Small Personal Financial Statement Financial Statement Profit And Loss Statement

To work out the ROI you use the formula.

Business valuation 3 x profit. Cash Flow x Multiple Asset Value 215000 x 30 650000 The value above includes. Based on these traditional sales-based valuations the business would be valued at 38500. All operating assets FFE.

I would think the value of your business would most likely fall in the range of 3 to 4 times a properly calculated EBITDA plus the value of any realty included in the sale. A business valuation might include an analysis of the companys management its capital structure its future earnings prospects or the market value of its assets. Total Sales Cost of Goods Sold Expenses Owners Wage TSDE your profit So when we say that a business was sold for a multiple of 244X for example it means that the amount paid for the business is a value of 244 times the profit.

1925 x 20 38500. The drawback to this valuation method is that is doesnt necessarily consider other factors such as an increasing or decreasing target market. With more than half of these businesses falling somewhere between 2-3 X.

The diagram below is a Compass Point variation on the rules-of-thumb valuation metric for lower middle market businesses businesses with earnings between around 500K and 20 million. In profit multiplier the value of the business is calculated by multiplying its profit. Spouses Compensation if not involved in business.

The industry profit multiplier is 199 so the approximate value is 40000 x 199 79600. For example consider 2 businesses each showing a net profit of 60000 annually. In this case your ROI is 25.

The two numbers give you an approximate range of potential values for your business. Total Estimated Value. This is a brief guide to business valuations for the lower middle market.

Value selling price net annual profitROI x 100. You can use trailing 12 months of profit or forecasted profit but be consistent. The valuation of a business is the process of determining the current worth of a business using objective measures and evaluating all aspects of the business.

Using the turnover valuation method the calculation would be as follows. Second calculate the average and the median profit multiple from the data you gathered. For a more complete guide please obtain the Valuation Guide using the form.

100108 52 weeks 1925 average turnover per week Average multiple for a café is 20 hence. You calculate that your business net profit was 50000 for the past year. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000.

The industry is trending toward franchises and since Subway. ROI 50000200000 x 100. This is the industry average youre going to use.

A companys value is always subjective and that is why these valuation ranges are so broad. Note that there will always be a discrepancy between the business value based on sales and the business value based on profits. 183561 213561 Estimated Business Value 30000 Liabilities Subways business-specific multiplier well exceeds the industry average multiplier of 196.

Profit sharing Other Discretionary expenses. Reliant Business Valuation is a leading business. This is versus a most likely 2 to 3 times discretionary cash flow.

If you have an ROI in mind you can use it to calculate the price for your business. Third multiply that average profit multiple by the profit of the company youre valuing.

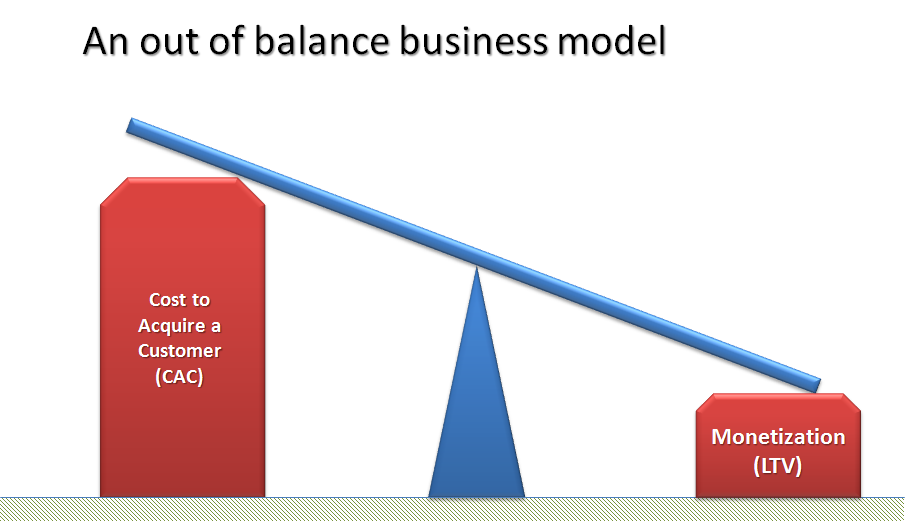

Startup Killer The Cost Of Customer Acquisition For Entrepreneurs

Business Valuation Methods Management Consulted

Saas Valuations How To Value Your Software Company In 2021

Saas Valuations How To Value Your Software Company In 2021

Saas Valuations How To Value Your Software Company In 2021

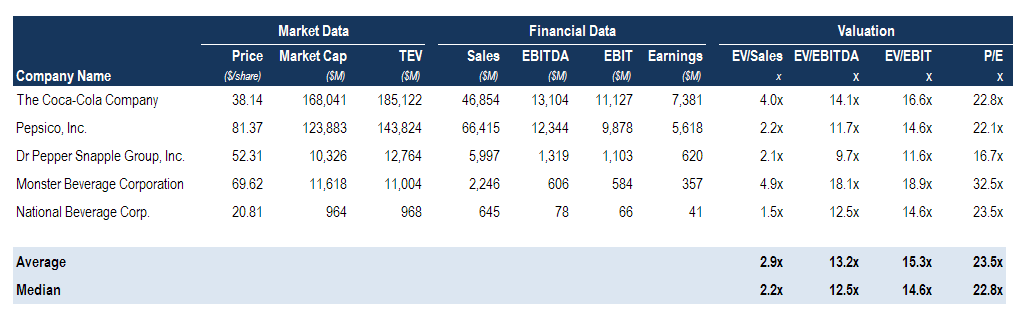

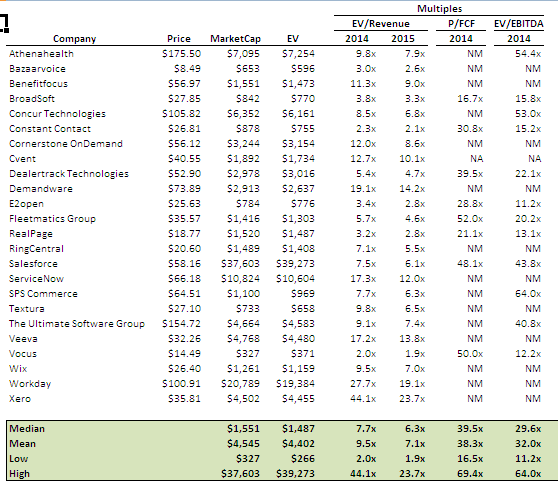

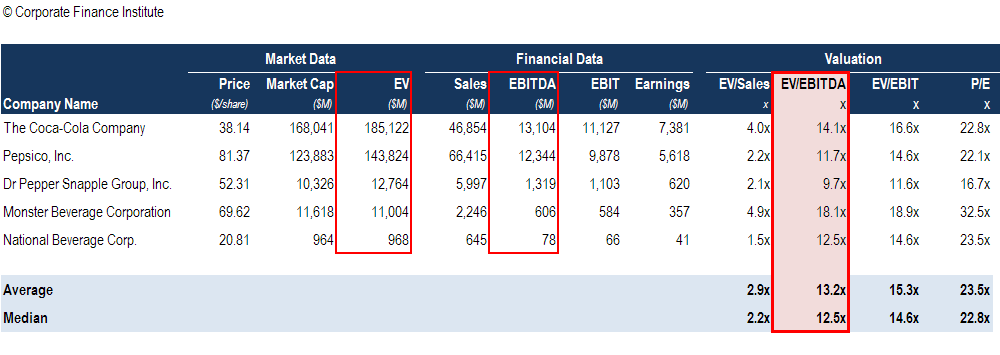

Comparable Company Analysis Free Guide Template And Examples

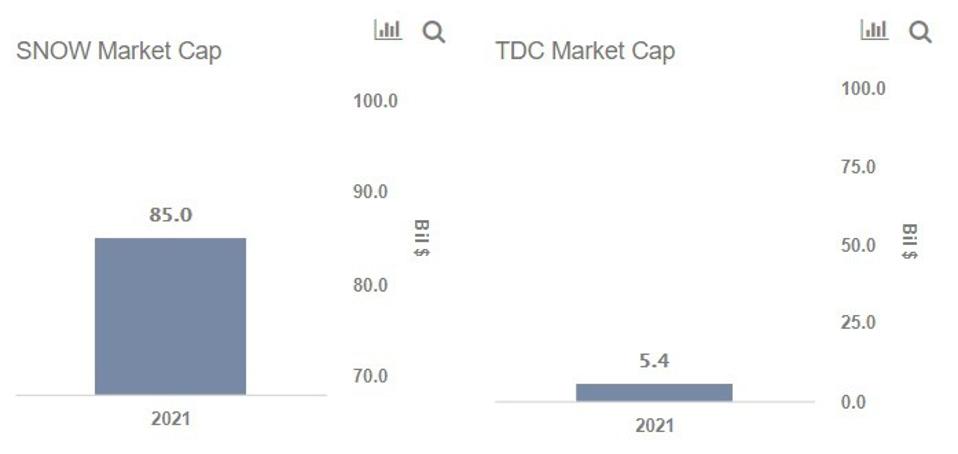

Snowflake Stock Looks Like Better Value After Q4 Results Recent Sell Off

Valuation Methods Guide To Top 5 Equity Valuation Models

Why Investors Are Paying 10x Revenue For The Best Software Companies By Kenn So Medium

The Most Common Ways On How To Evaluate Early Stage Companies Eu Startups

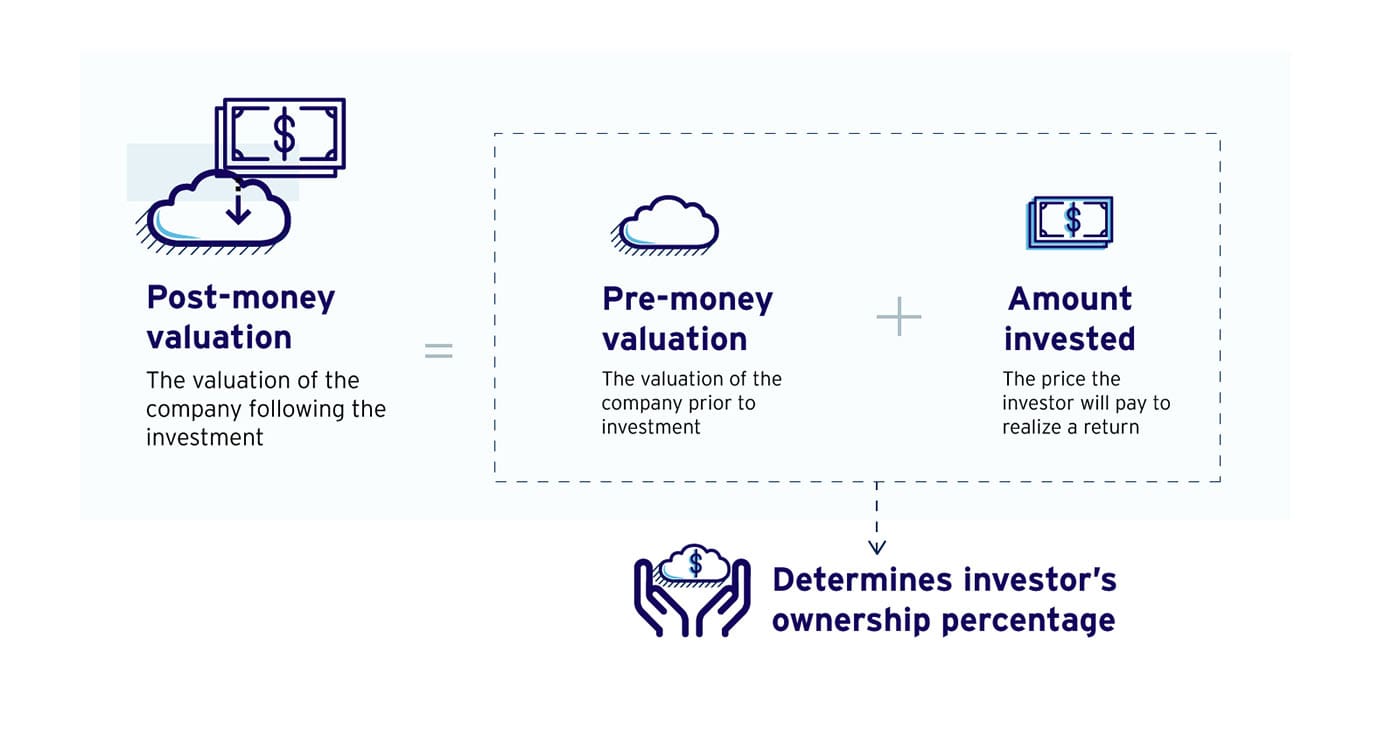

Business Valuation How Investors Determine The Value Of Your Business Entrepreneur S Toolkit

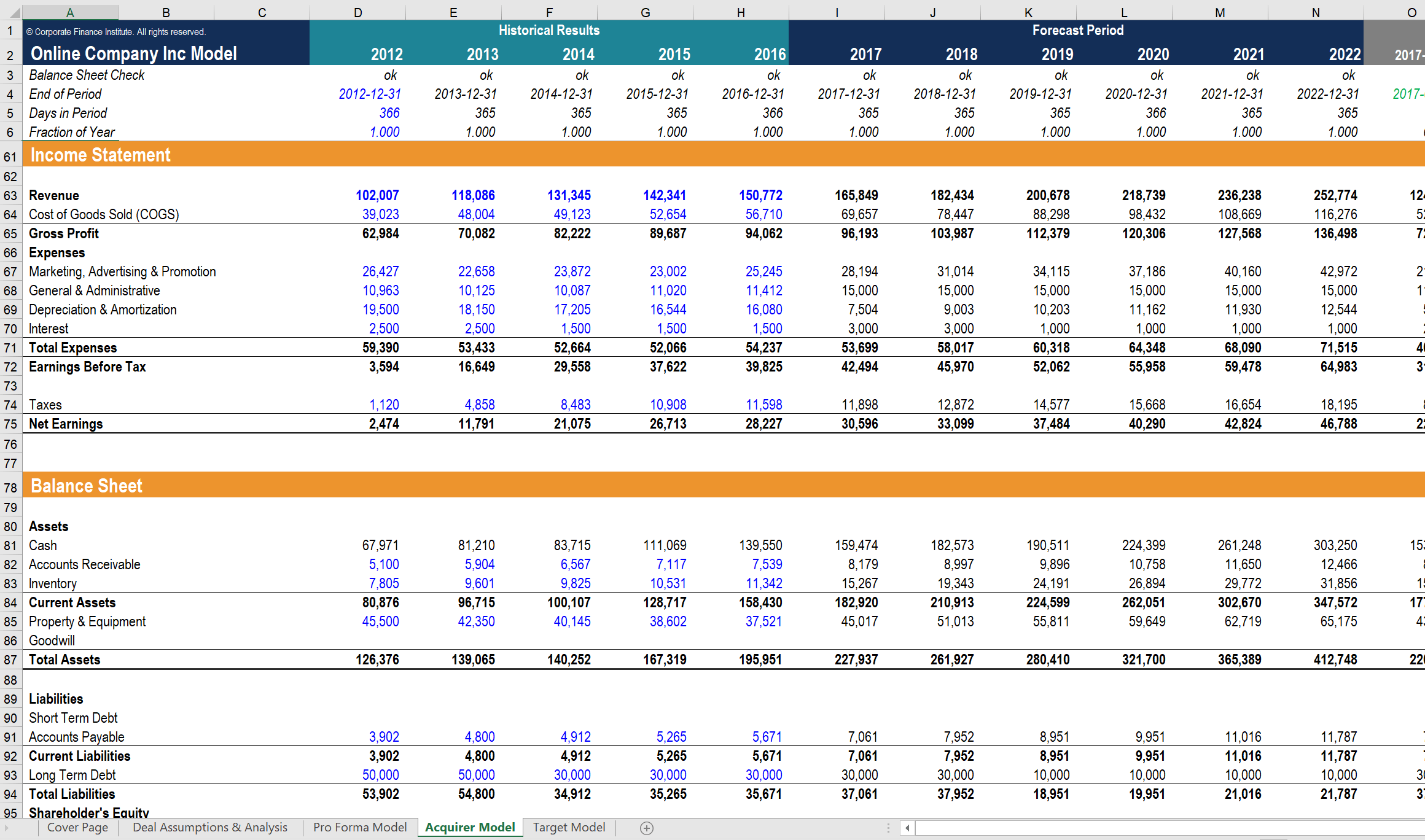

Valuation Modeling In Excel Learn The 3 Most Common Methods

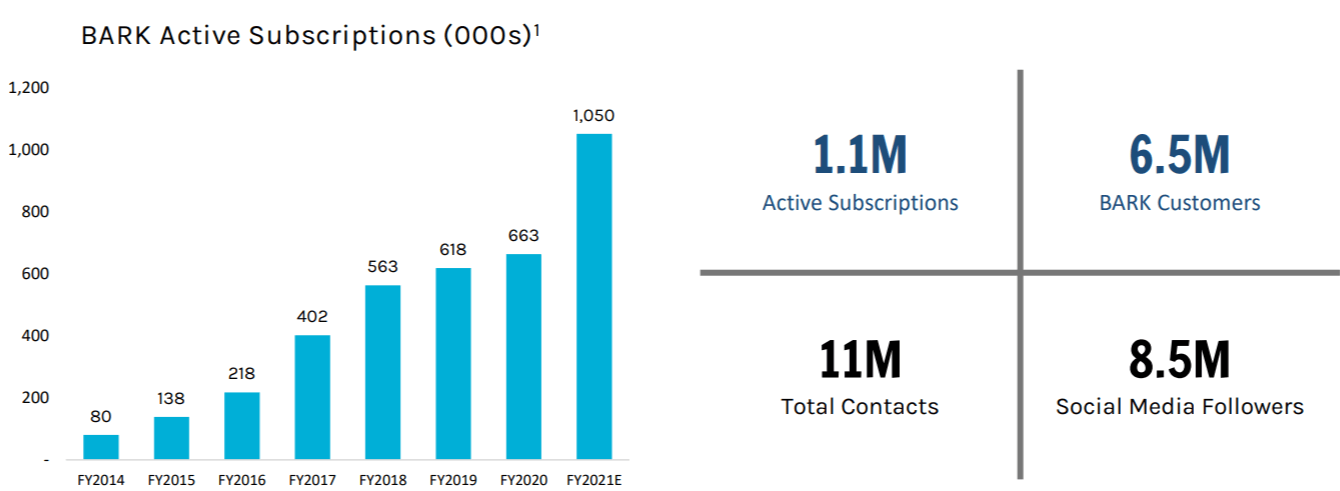

Barkbox High Growth Company At A Compelling Valuation Nyse Stic Seeking Alpha

Ebitda Multiple Formula Calculator And Use In Valuation

Accurate Business Valuation In Singapore Business Valuation Business Profit Shares

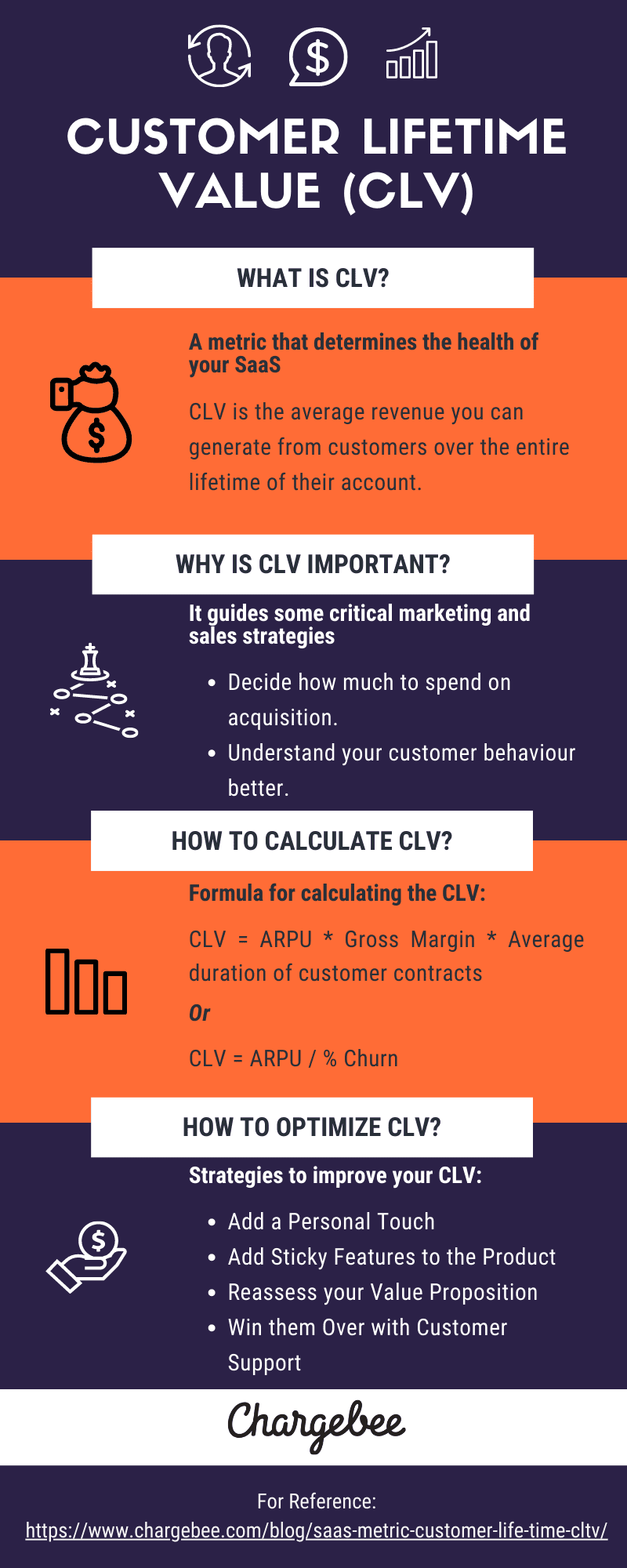

What Is Customer Lifetime Value Clv Why Is It An Important Saas Metric

Financial Model For Mobile App Business Efinancialmodels Cash Flow Statement Financial Plan Template Business Valuation

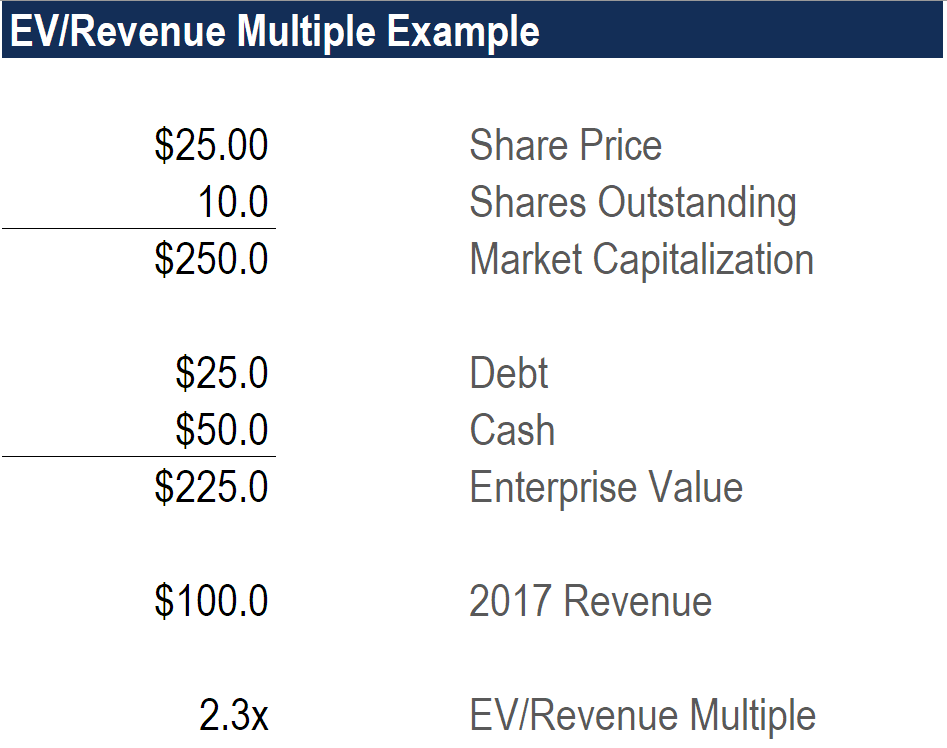

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Business Valuation Methods And Examples

Post a Comment for "Business Valuation 3 X Profit"