Corporate Tax Id Korea

In general no special taxes are levied on gains from mergers. Automated data import from accounting systems.

Japan And South Korea Trade War White List Economy Conflict Tax U002f Japan Rally To Declare A Boycott South Korea Goods Expo Stock Market Graph Japan Economy

For resident companies capital gains are treated as ordinary business income and taxed at the normal corporate tax rate.

Corporate tax id korea. In South Korea the Corporate Income tax rate is a tax collected from companies. Its amount is based on the net income companies obtain while exercising their. 1 Corporate Income Tax 11 General Information Corporate Income Tax.

Hello guys This is a video about how to create Tax refund ID and how to apply online in south korea. The information contained in this booklet is current as of May 2019.

Built-in return forms including corporate. It has any fixed place of business in Korea where the business of the entity is wholly or partly carried on. Pre-announced tax law amendments include important corporate income tax changes in Korea Several tax reform proposals will be effective in Korea as from mid-March 2021 following a pre-announcement of the new legislation an interdepartmental consultation and an evaluation by the Ministry of Government Legislation.

This booklet presents a brief overview of Korean corporate and individual income taxes. Apply for Tax Id Number Information Federal Tax Identification Number A Tax Identification Number EIN and or a Federal Tax Identification Number which is used to identify a Korea Business. Tax Id Number Obtain a tax id form or a Korea tax id application here.

Intuitive software with minimal training requirements. A Resident Registration Number and a Business Registration Number. PE in Korea in the following cases among others.

Corporate income tax CIT in Korea Corporate income tax CIT CIT is imposed on the taxable income of domestic corporations foreign corporations and other entities treated as corporations for South Korean tax purposes. CHAPTER CORPORATE TAX ON INCOME OF FOREIGNⅣ CORPORATION FOR EACH BUSINESS YEAR SECTION 1 Tax Base and Its Calculation Article 91 Tax Base Article 92 Calculation of Amount of Income Generated from Sources in Korea Article 93 Income Generated fromSources in Korea Article 94 Domestic Place of Business of Foreign Corporation. 154 for interest on bonds.

Wish you always be SAFE HE. It has any fixed place of business in Korea where the business of the entity is wholly or partly carried on. Types of Tax Id Numbers There are four types of tax ids.

PE in Korea in the following cases among others. Hope this video helps you. - 01-79 sole proprietor liable for value-added tax VAT - 90-99 sole proprietor exempted from value-added tax VAT - 89 non-corporate religious organization.

10 on the first KRW 200 million of the tax base 20 up to KRW 20 billion 22 up to KRW 300 billion 25 for tax base above KRW 300 billion. A corporate tax ID is interchangeably used with EIN which applies to entities other than corporations as well Selva Ozelli international tax attorney and CPA told Business News Daily.

Fully maintained tax calculations and rates without the need for independent safeguards or audit committee approvals. Automatic roll-forward of prior year data. It is represented by a dependent agent in Korea who has the authority to conclude contracts on its behalf and who has repeatedly exercised that authority.

For non-resident companies Korean-source capital gains are taxed at either 11 of sales or 22 of gains whichever is less. Republic of Korea Last update 12-04-2018 Information on Tax Identification Numbers Section I TIN Description In Korea two types of Tax Identification Number TIN are used for filing tax returns. A tax presence ie.

Corporate taxpayers are liable for the minimum tax which is defined as the greater of 10 if the tax base is KRW 10 billion or less 12 on the tax base exceeding KRW 10 billion but not more than KRW 100 billion 17 on the tax base exceeding KRW 100 billion of the taxable income before certain tax deductions and credits pursuant to the STTCL or the actual CIT liability after various. Permanent establishment PE A non-resident corporation is generally deemed to have a tax presence ie. The basic Korean corporate tax rates are currently.

ONESOURCE Corporate Tax Korea offers. A Summary of Korean Corporate and Individual Income Taxes 2019. 22 for interest on loans dividends and royalties.

The Business Registration Number covers the following types of organization as designated by the middle two digits of the number. Withholding tax is charged on each separate item of South Korean-sourced income for foreign corporations without PEs and the applicable withholding tax rates on corporate transactions are as follows.

Korea Republic Of Indirect Tax Guide Kpmg Global

How To Check Income Tax In Korea Home Tax Korea Tax Refund Korea Tax Web Site Southkorea Youtube

Guide To Getting Vat Tax Refunds On Your Shopping In Seoul South Korea Singapore Travel Blog Singapore Travel Travel Blog South Korea Travel

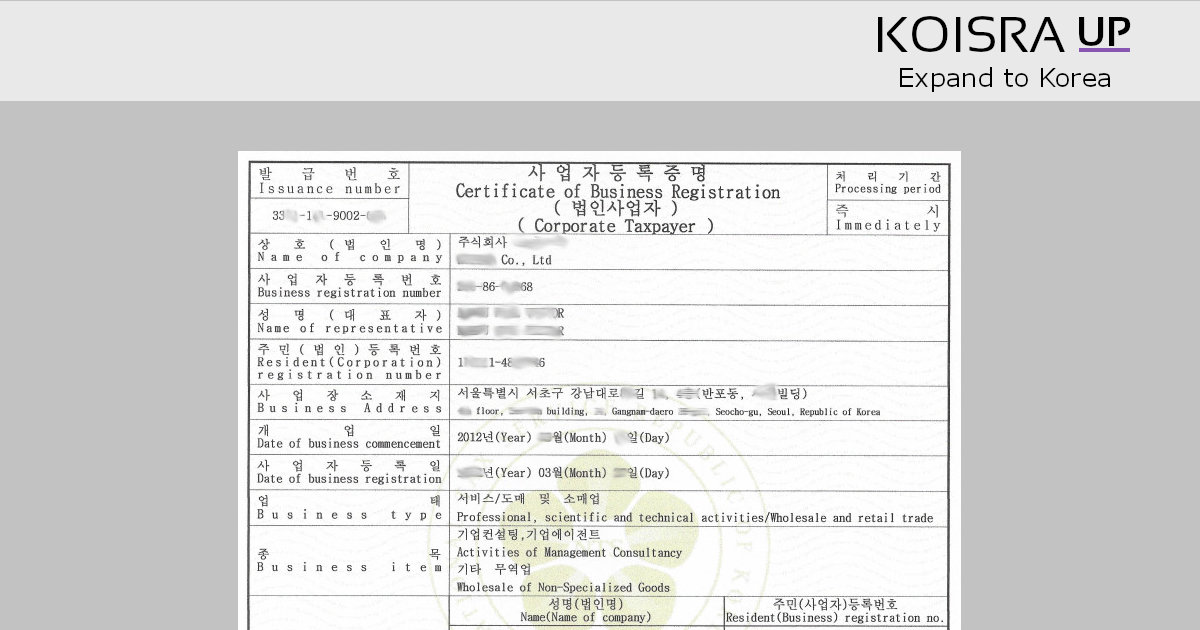

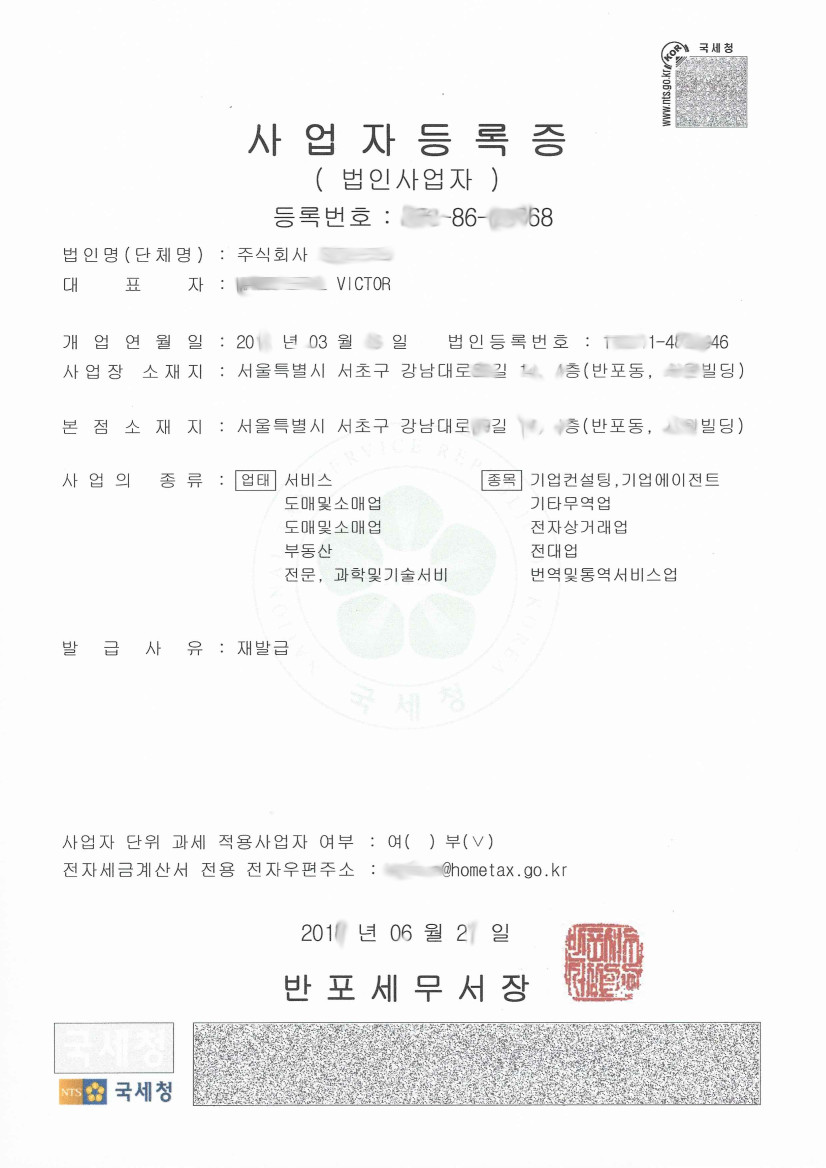

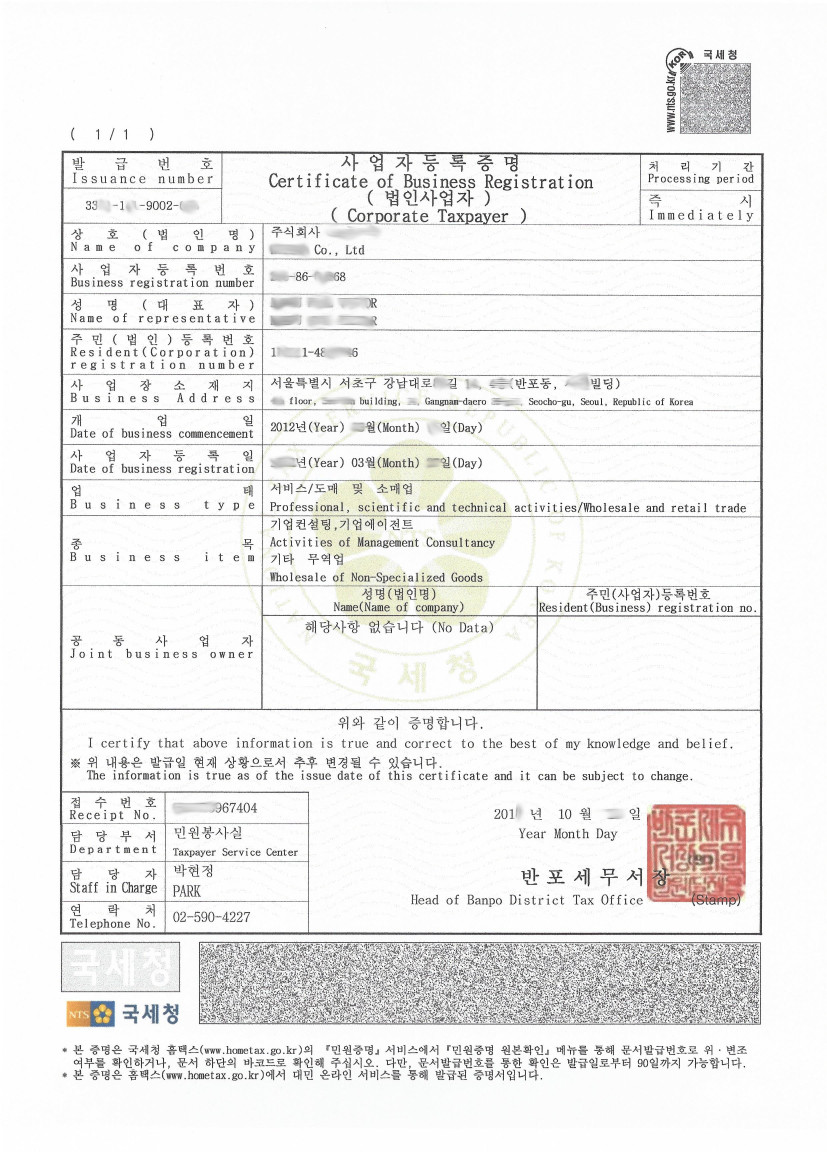

Business And Companies Registration In Korea Koisra Up

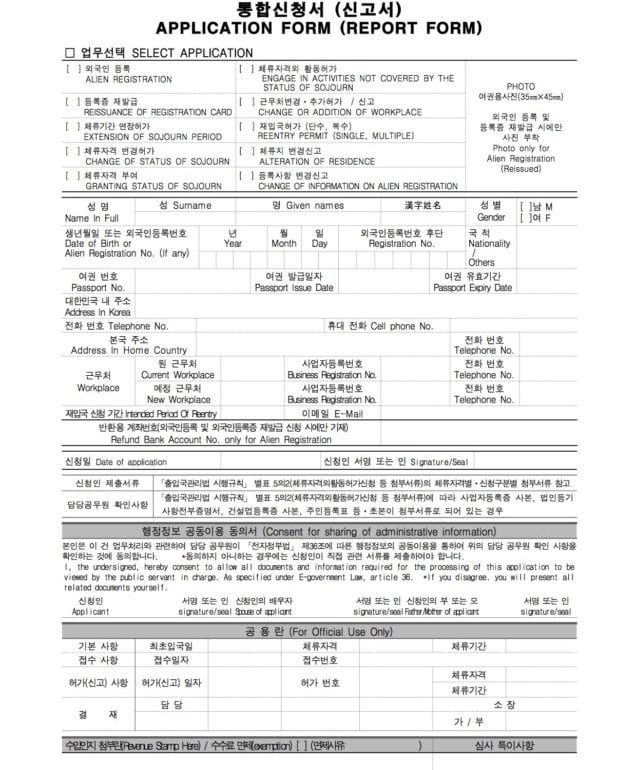

How To Get Visas And Work Permits For South Korea Internations Go

Tax Return Korea Tax Id Home Tax Korea South Korea Tax 2019 2020 Youtube

Business And Companies Registration In Korea Koisra Up

Fbi And Irs Alert W2 Phishing Scams Managed It Services By Petronella Technology Group Managed It Services Employer Identification Number Federal Income Tax

469 Value Added Tax Refund Vat Ii Langue Coreenne Coreen Coree Du Sud

S2 168 Su Instagram Passport Fly Travel Document Korea Selatan Buku Buku Lagu

Simple Tax Guide For Americans In Korea

Sprint Tutorial Carding Method Working Well Going To Share What I Know About This Company Tax Id Well First Of All Go To E Tutorial Method Learn Programming

Http Www Oecd Org Tax Administration 39545645 Pdf

How To Fill Out Irs Form 8802 Us Residency Certificate Irs Forms Irs Application Form

The Complete Alien Registration Card Arc Guide In Korea 10 Magazine Korea

Alien Registration Card Immigration Overview Ibs

Business And Companies Registration In Korea Koisra Up

Http Www Oecd Org Tax Administration 39545645 Pdf

Http Www Oecd Org Tax Administration 39545645 Pdf

Post a Comment for "Corporate Tax Id Korea"