Business Valuation 3x Profit

Use this calculator to determine the value of your business today based on discounted future cash flows with consideration to excess compensation paid to owners level of risk and possible adjustments for small size or lack of marketability. Total Estimated Value.

How To Measure Profitability In A Service Based Business

This information may help you analyze your financial needs.

Business valuation 3x profit. What are the growth trends. For example a business that is doing 300000 in profit per year sold for at 244X would have a sale price of 732000 300000244732000. Rather the most important factor in valuations is understanding the industry and nature of the business.

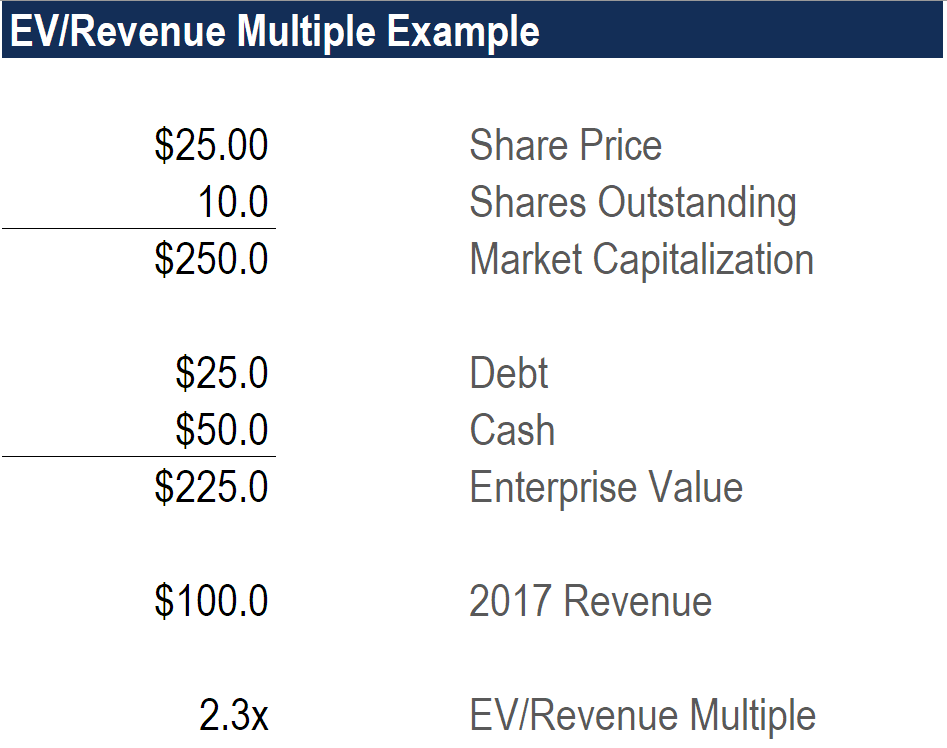

You can take any price and divide it by the annual revenue of a business and obtain a revenue multiple or fraction thereof. With over 100 years of combined experience our team has been a leader in the industry by helping the owners of privately-held companies cash in on all their hard work. National Business Valuation Services Inc.

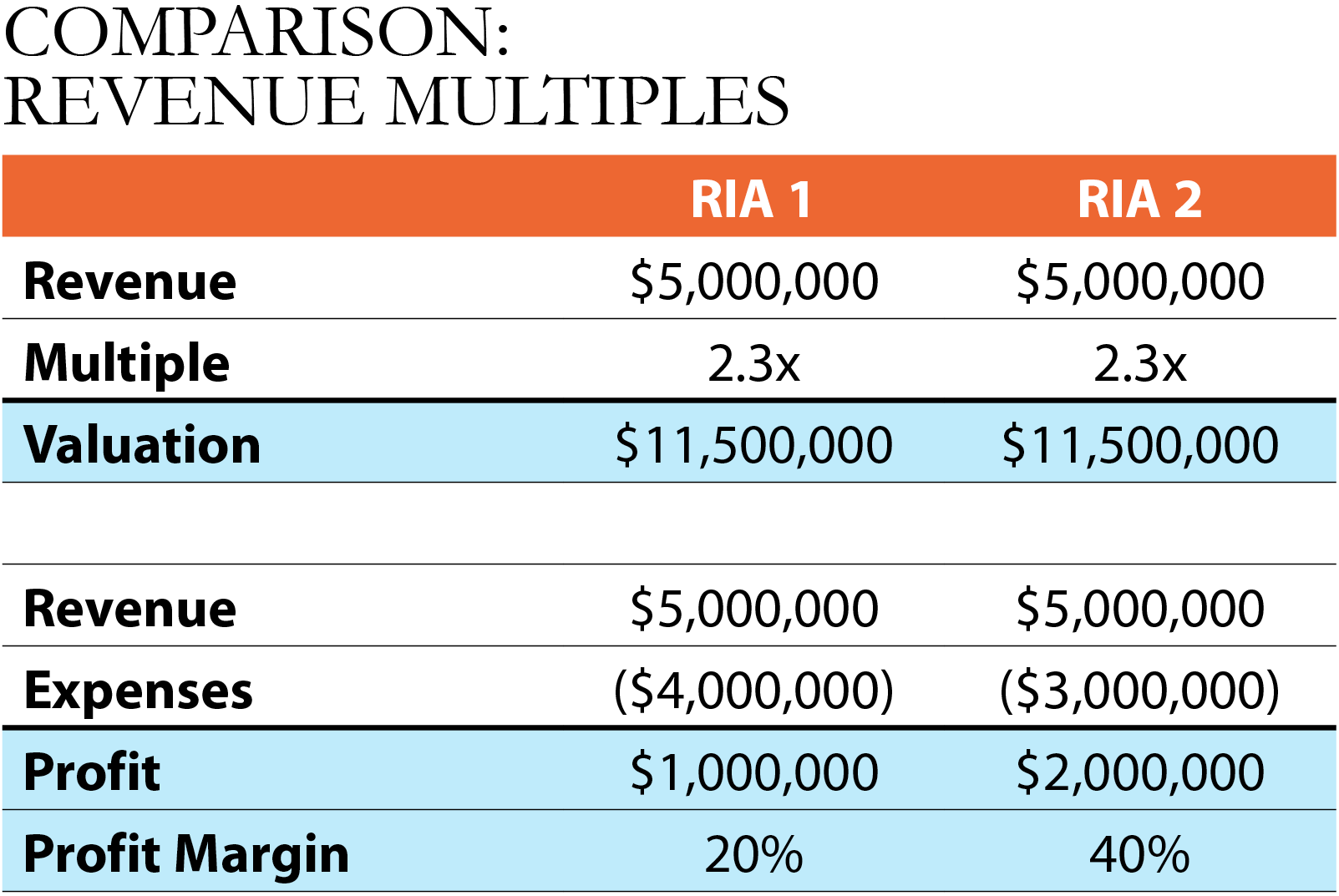

Commonly a business with a low EBITDA multiple can be. A tech company with 500000 in earnings might be worth 3x revenue or 15 million. Note that there will always be a discrepancy between the business value based on sales and the business value based on profits.

12655 N Central Expy Ste 700. The valuation of a business is the process of determining the current worth of a business using objective measures and evaluating all aspects of the business. Sometimes it more than doubles revenue.

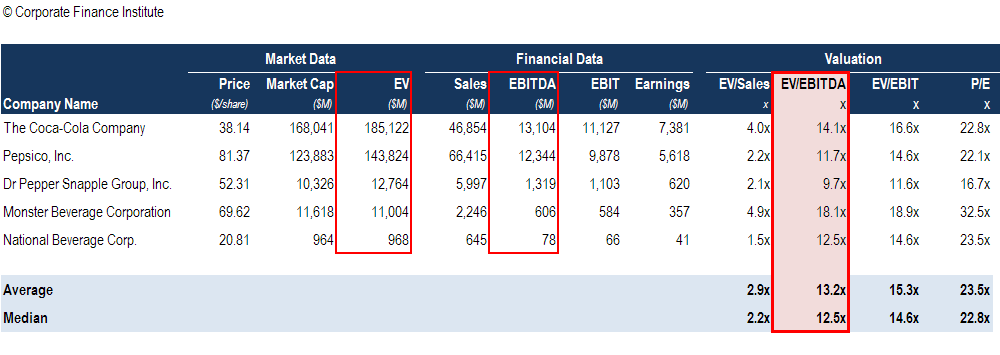

What systems and processes are in place to run the business. Using company earnings from the last 12 months as a base this method multiplies that revenue accordingly. DCF analysis comparable companies and precedent transactions often to find attractive takeover candidates for a merger or acquisition.

The two numbers give you an approximate range of potential values for your business. Or another more accurate guidleine is 1 to 25 times discretionary earnings adjusted cash flow plus inventory for businesses with discretionary earning below 100K and 3 times discretionary earnings for businesses over 100K in earnings. In some high growth technology companies people talk about a multiple such as 2x or 3x Revenue Company value.

RWS Business Valuation SE. YEARS IN BUSINESS. A business valuation might include an analysis of the companys management its capital structure its future earnings prospects or the market value of its assets.

But over the 25 years that our firm has been selling businesses weve learned that there are very few hard and fast rules that you can apply to any valuation. Real Estate Appraisers 972 235-6287. It is used extensively as a valuation technique Valuation Methods When valuing a company as a going concern there are three main valuation methods used.

The accepted valuation methodology by buyers is the multiple of earnings method. The industry is trending toward franchises and since Subway. TSDE your profit So when we say that a business was sold for a multiple of 244X for example it means that the amount paid for the business is a value of 244 times the profit.

For a more complete guide please obtain the Valuation Guide using the form. 183561 213561 Estimated Business Value 30000 Liabilities Subways business-specific multiplier well exceeds the industry average multiplier of 196. In profit multiplier the value of the business is calculated by multiplying its profit.

Auto repair shops are valued at 35 to 45 of annual revenue plus inventory at cost. Steve thanks for dropping by the blog. Business Plans Development Pension Profit Sharing Plans Accountants-Certified Public 817 481.

Part of the valuation process is looking at historical sales of similar businesses and comparing your business to those. Sometimes the multiplier is lower than earnings. This is a brief guide to business valuations for the lower middle market.

The diagram below is a Compass Point variation on the rules-of-thumb valuation metric for lower middle market businesses businesses with earnings between around 500K and 20 million. Medium in the 2-3X multiple. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000.

A 1 million sale price divided by 25 million in annual revenue equals a 040x revenue multiple. So rather than telling you all businesses sell for between 3X and 5X net. IAG MA Advisors is a business intermediary consulting firm facilitating the buying selling of businesses.

What is the profit. The industry profit multiplier is 199 so the approximate value is 40000 x 199 79600.

The Average Amazon Seller S Profit Margin What Is Amazon What To Sell Sell On Amazon

How To Present Your Startup Financials In Just 3 Slides Slide 3 Unit Economics Start Up Financial Economics

Revenue Multiple Demystified Tech Valuations 101

Tripwire Funnels In 2021 Affiliate Tools Funnel Funnels

These Content Marketing Examples Provide Insight On How To Structure Your Content Marketing Strategy To Content Marketing Content Marketing Strategy Marketing

Expectation Management Is My Company A 1x Or A 3x Revenue Business Harbor Ridge Capital

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Upstream Oil And Gas Project Template Efinancialmodels Cash Flow Statement Financial Modeling Financial Information

Valuation Of Ria Firm Skyview Partners

Domain Names Investment Tools Financial Institutions Affiliate Marketing Programs

How To Leverage Affiliate Marketing To 3x Your Revenue In 2020 Affiliate Marketing Content Marketing Strategy Affiliate Marketing Strategy

How Much Do Contractors Make Google Search Kids Meals Healthy Dinner Recipes Easy Dinner Recipes For Kids

Business Valuation Multiples By Industry Nash Advisory

I4cp Trendwatcher The People Profit Chain A Model To Increase Market Performance By Up To 3x Marketing Business Strategy Performance

Expectation Management Is My Company A 1x Or A 3x Revenue Business Harbor Ridge Capital

Why Investors Are Paying 10x Revenue For The Best Software Companies By Kenn So Medium

Ebitda Multiple Formula Calculator And Use In Valuation

Nps Progressive Insurance Case Study Progressive Insurance Case

Post a Comment for "Business Valuation 3x Profit"