Small Business Tax Id Number Texas

Nontransferable in that an individual cannot transfer his tax identification number to another person or entity- a new tax identification number will be required. Of course you still need to comply with all the business regulations including finding out how to get a tax ID number in Texas.

How To Get A Tax Id Number For A Business In Texas Financeviewer

You should get one right after you register your new business.

Small business tax id number texas. Apply for a Texas Tax ID EIN Number Online. When you call the representative will require some identifying information to ensure you are the person authorized to receive the EIN. Internal Revenue Service Phone.

Obtaining a Tax ID Number EIN When starting a business in Texas serving as the administrator or executor of an estate creator of a Trust or operating a Non Profit Organization obtaining a Tax ID EIN is a key responsibility. Texas Small Business Tax Id 77043. Once you have submitted your application your EIN will be delivered to you via e-mail.

An EIN is a nine-digit number for example 12-3456789 assigned to sole proprietors corporations limited liability companies LLC partnerships estates trusts and other entities for tax filing banking and business purposes. Basic federal tax information for new businesses including information about EINs business taxes and general small business resources. The Texas taxpayer number or TIN has 11 digits while the EIN has nine digits.

Employer Identification Numbers are issued for the purpose of tax administration and are not intended for participation in any other activities eg tax lien auction or sales lotteries etc. Guide to the Employer Identification Number. Sole Proprietor Individual.

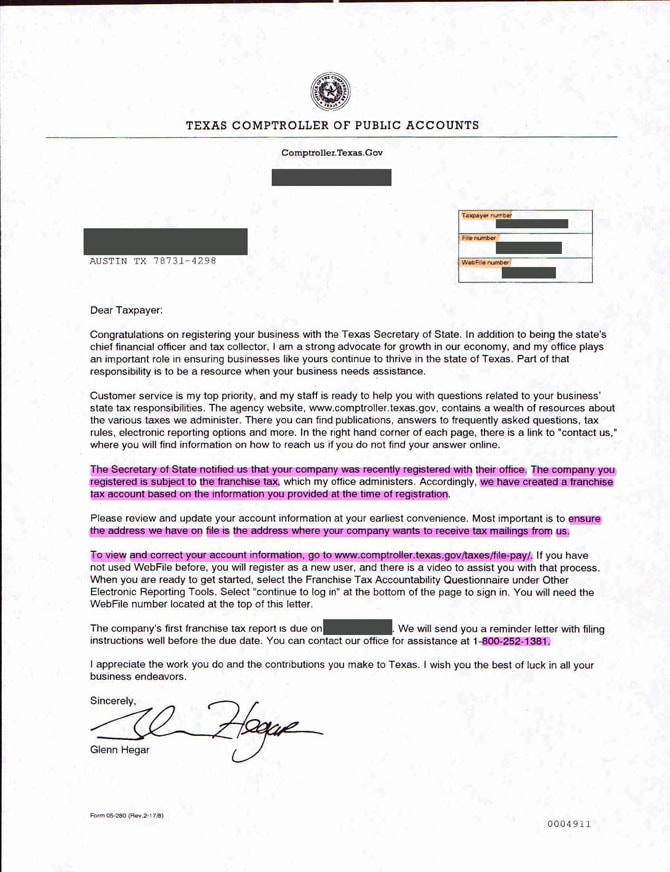

The tax ID number or employer identification number comes from the IRS. If a sole proprietorship. If a business applies for a sales tax permit before obtaining a federal employers identification number the Comptrollers office will issue a permit under a temporary number.

TxSmartBuy - State and Local Bid Opportunities. Small Business and Self-Employed. It lets you legally hire employees pay taxes and open a business.

Apply for an Employer Identification Number EIN Online. Small Business Administration - Texas. Preform a lookup by Name Tax ID Number or File Number.

Homemade Soap And Crafts Houston TX 77043. Internal Revenue ServiceStarting a Business. However if you find that you dont need the EIN the IRS can close your business.

Your first tax period would end. Once you finalize your application and are assigned an EIN the number can never be canceled. A Tax ID also known as an Employer ID Number EIN is a unique nine digit number that identifies your business or entity with the IRS for tax purposes essentially like a Social Security.

Application for Employer Identification Number Form SS-4 PDF. Unemployment Tax Collected by the Texas Workforce Commission. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

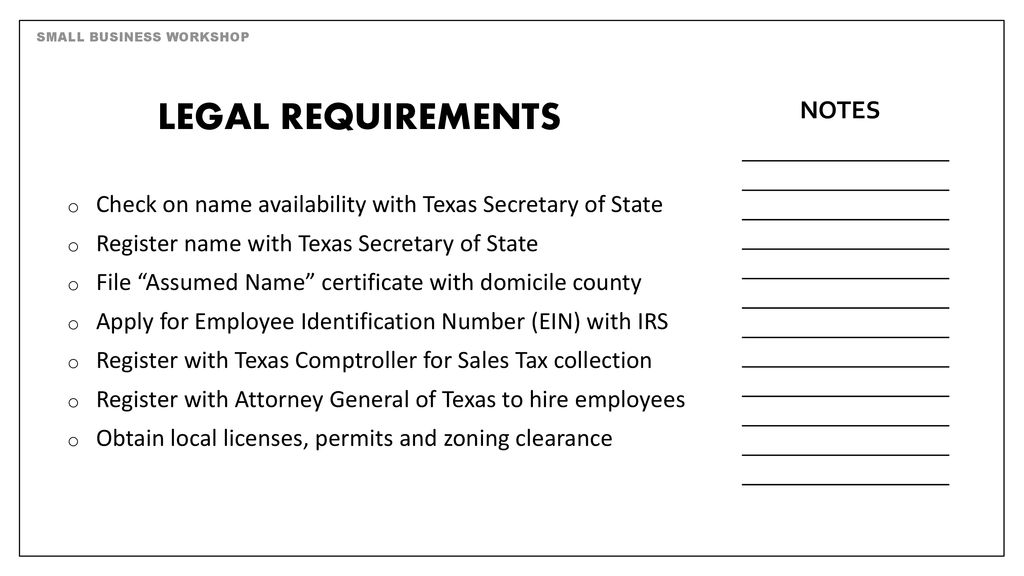

Those businesses operating within the state of Texas are additionally required to register for more specific identification numbers licenses. As an entrepreneur you need both state tax ID and federal tax ID numbers to run your business file tax returns pay wages get a tax-deferred. To begin your application select the type of organization or entity you are attempting to obtain a Tax ID EIN Number in Texas for.

When preforming your lookup by name be sure to include as many keywords as you can in order to to have the best results. Most businesses need an Employer Identification Number EIN. The former is assigned by the states comptroller and serves the same purpose as the federal tax ID number.

Your EIN is your federal tax ID number. If you ever lose your EIN you can always call the IRS Business Specialty Tax Line at 800-829-4933. The process to get a state tax ID number is similar to getting a federal tax ID number.

Search for a business entity Corporation LLC Limited Partnership in Texas by going to the Secretary of States Website. Most businesses must file and pay federal taxes on any. How to Apply for an EIN.

When we receive the federal employers identification number we will then issue a new permit based on the federal number. Employer Identification Number EIN 9 digits Section 1 Social Security number SSN 9 digits Individual Taxpayer Identification Number ITIN 9 digits Comptrollers assigned number FOR STATE AGENCY USE ONLY 11 digits Current Texas Identification Number FOR STATE AGENCY USE ONLY 11 digits 3. If you are opening a business or other entity that will have employees will operate as a Corporation or Partnership is.

MacRobert Apple Blossom Farm Opening a new business my Fort Bend County Texas Small Business Tax Id own online home business. After completing the application you will receive your Tax ID EIN Number via e-mail. Step 1 Start.

To know whether you need a state tax ID research and understand your states laws regarding income taxes and employment taxes the two most common forms of state taxes for small businesses. For similar reasons the life of the business is limited to the life of the sole proprietor. Apply for a Texas Tax ID EIN Number To obtain your Tax ID EIN in Texas start by choosing the legal structure of the entity you wish to get a Tax ID EIN for.

Your EIN on the other hand will be assigned by the IRS. A sole proprietorship is often operated under the name of the owner. Find out from the IRS if you need an EIN how to get one what to do if youve lost or misplaced yours and more.

Application Small Business Certification Www Texassba Us Business Certifications Small Business Start Up Small Business

Employer Identification Number Ein

Texas Sales And Use Tax Exemption Certification Blank Form Ideal Throughout Resale Certificate Request Letter Template Letter Templates Lettering Blank Form

Why Texas Is Good For Business Texas Is Creating Jobs And Thriving While Many States Like California Infographic Business Infographic Small Business Resources

Temporary Texas Drivers License Template Templates Drivers License Card Templates

Comptroller Texas Gov Taxinfo Taxpubs Tx94 105 Pdf Tax Forms Financial Tips Property Tax

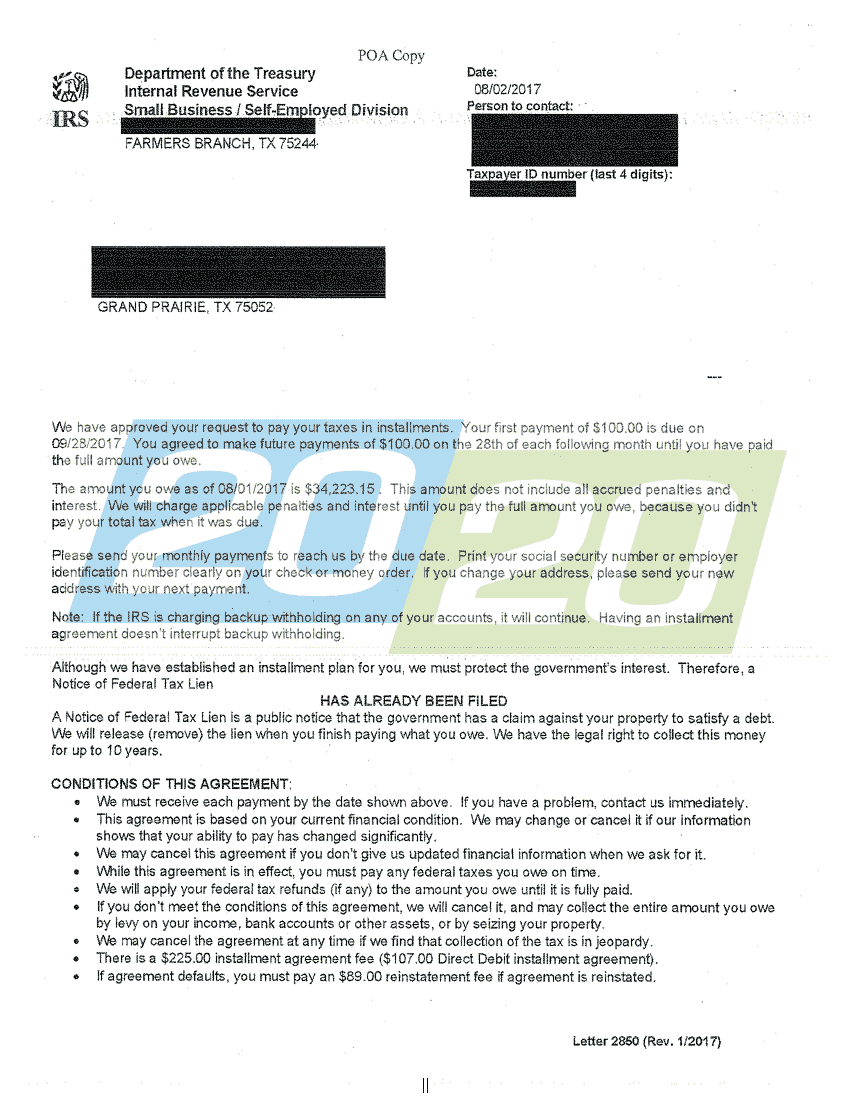

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Debt Relief Programs Irs Taxes Credit Card Debt Relief

Texas Llc Certificate Of Formation Pdf Download Startingyourbusiness Com

Llc In Texas How To Start An Llc In Texas Truic Guides Limited Liability Company Best Templates Registered Agent

How To Get A Tax Id Number For A Business In Texas Financeviewer

We Can Help You Pay Your Taxes On Time Accounting Firms Bookkeeping Services Online Bookkeeping

How To Start A Business In Texas A Truic Small Business Guide

Certificate Of Liability Insurance Coi How To Request Throughout Certificate Of Liability Insurance Te Liability Insurance Certificate Templates Insurance

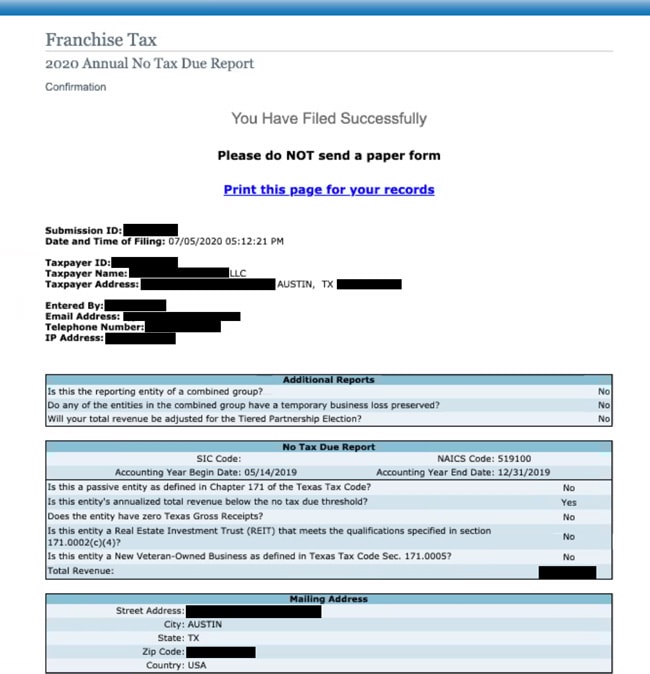

Texas Llc No Tax Due Public Information Report Llc University

How Much Does A Small Business Pay In Taxes

Texas Llc No Tax Due Public Information Report Llc University

Best States To Move An Llc To Infographic Infographic Infographic Marketing Business Infographic

How To Get A Resale Certificate In Texas Startingyourbusiness Com

How To Get A Tax Id Number For A Business In Texas Financeviewer

Post a Comment for "Small Business Tax Id Number Texas"