Business Use Of Home Excess Mortgage Interest

The Excess Mortgage worksheet in the Individual module of Lacerte is based off the IRS Worksheet To Figure Your Qualified Loan Limit and Deductible Home Mortgage Interest for the Current Year from Pub 936. Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction.

Partner Home Office Deductions Under Covid 19

Can anyone explain this to me.

Business use of home excess mortgage interest. For example suppose you have 10000 of mortgage interest and the home office percentage of your home. Imagine you have a 500000 mortgage on your 4000 square-foot home and you pay 24000 in mortgage interest for the year. What is the Excess Mortgage worksheet.

Select the home office asset type from the drop-down list and press TAB. This may allow you if the limits in Part II apply more of a deduction for interest on other debts that are deductible only as home mortgage interest. Schedule A Excess Home Mortgage Interest with More Than Four Loans To enter a payoff include any principal paid before the payoff plus the entire payoff amount in the field Total principal paid The field Lump sum principal payment if paid off should include only the payoff amount.

The business portion of your home mortgage interest allowed as a deduction this year will be included in the business use of the home deduction you report on Schedule C Form 1040 line 30 or Schedule F Form 1040 line 32. I have the 8829 worksheet line 11 going to form 8829 line 17 excess real estate taxes under direct column and line 7 going to schedule A line 5b. The personal portion of your home mortgage interest will generally be the amount of deductible home mortgage interest you figured when treating all home mortgage interest as a personal expense and applying the Schedule A Form 1040 limits on deducting home mortgage interest reduced by the business or rental portions deducted or carried over as a business or rental expense on Schedule C E or F or any form other than Schedule A.

Under this safe harbor method depreciation is treated as zero and the taxpayer claims the deduction directly on Schedule C Form 1040 or 1040-SR. If you are NOT using the simplified method to report home business expenses. If the amount of home mortgage interest or qualified mortgage insurance premiums you deduct on Schedule A Itemized Deductions is limited enter the part of the excess that qualifies as a direct or indirect expense.

Well automatically split the amount you enter based on how much of your home is used for the business. It is considered an indirect expense unless you have mortgage interest specifically for a separate structure you use to run your business. Since you can also claim mortgage interest on your Schedule A it is worth looking into the IRS rules about how to manage the two.

You may want to treat a debt as not secured by your home if the interest on that debt is fully deductible for example as a business expense whether or not it qualifies as home mortgage interest. This is where you would enter interest paid on your mortgage. If you have a home office for the purposes of federal income taxes then there are two ways you can deduct the mortgage-interest expense and property.

Do not include mortgage interest on a loan that did not benefit your home. If you select Home the fields in the Business use of a home and Allowable deductions group boxes become available. This worksheet is calculated using the amounts you enter in the Excess Mortgage Interest section of Screen 25 Itemized.

You should enter the entire amount of mortgage interest points and private mortgage insurance PMI in both the Home Office section and the Form 1098 area of the Itemized Deductions section. If I check the box to allocate all mortgage interest and real estate taxes as excess tax goes up because mortgage interest also moves down to line 16 excess mortgage interest. Mortgage interest is an indirect expense unless you pay mortgage interest for a separate structure that you use for your business.

If you know youre taking the standard deduction you will enter all the mortgage interest for the home used for. My home office is only 82 of the whole home so I checked the box Yes to have the rest of the mortgage interest deducted for the rest of the home. You can only enter your mortgage interest here if youre not taking the standard deduction.

If you do itemize your deductions you can learn more about how to calculate the amount on line 10. On the business use of home form it moves the interest and property taxes down to excess mortgage interest and property taxes but still in the indirect expenses column and still takes. I also originally added the 1098 Mortgage Interest Property Tax information in the Personal Deductions section.

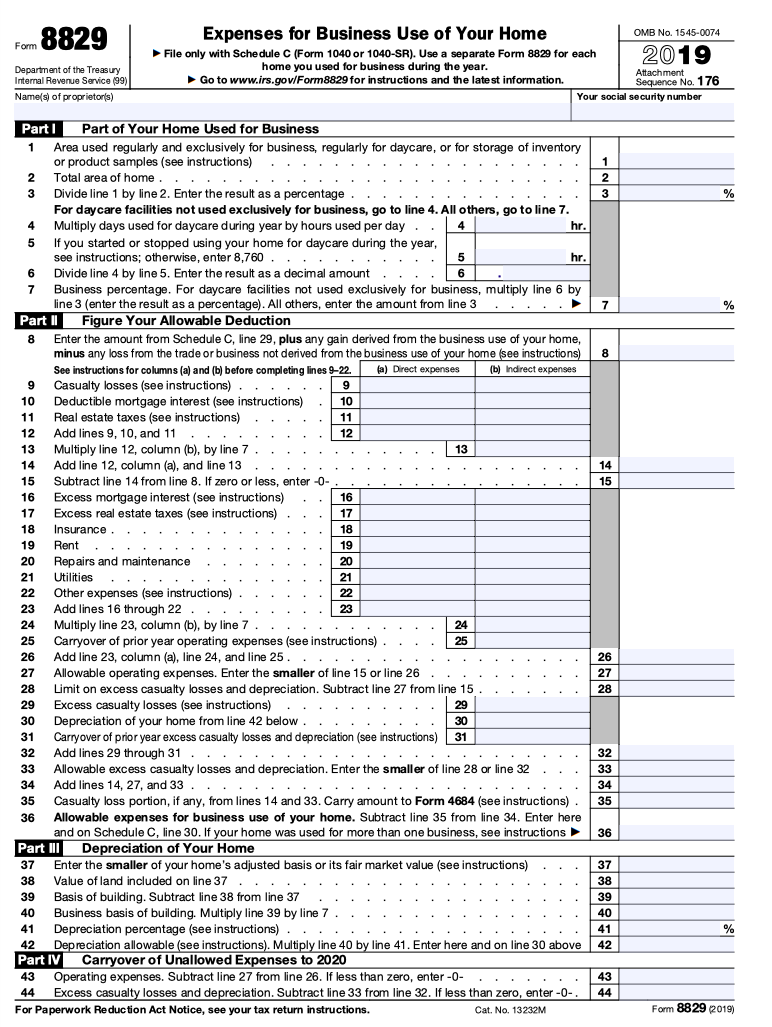

If you select Improvements the field in the Improvements group box becomes availableIf you have entered two home offices mark the appropriate Home office option to distinguish whether the asset belongs. Use Form 8829 to figure the allowable expenses for business use of your home on Schedule C Form 1040 and any carryover to next year of amounts not deductible this year. I originally entered my mortgage interest and property taxes in the Business Home Office section.

Buying A Home Is 45 Cheaper Than Renting Home Buying Mortgage Payoff Mortgage Loan Originator

Personal Business Loans Home Equity Loans Online Types Of Home Equity Lo Home Equity Loan Home Equity Home Improvement Loans

Irs Topic 500 Itemized Deductions Http Www Irs Gov Taxtopics Tc500 Html Tax Itemize Financial Money Irs Irs Taxes Deduction Accounting Information

How A Home Equity Loan Works Freeandclear Interest Only Mortgage Home Equity Loan Adjustable Rate Mortgage

Hector Alvarez 802 432 8672 On Instagram I Want To Get You All Ready For Tomorrow When You Awaken I Wan How To Better Yourself How To Find Out How To Get

How To Fill Out Form 8829 Bench Accounting

3 Things Home Buyers Need To Know About Mortgage Interest Real Estate News And Advice Realtor Com Bond Funds Mortgage Interest Best Bond

Tax Deductions For Home Mortgage Interest Under Tcja

Rental Property Tax Deductions Tax Deductions Being A Landlord House Rental

2945305d4b6bf3dcaabc06d1d642253a Jpg 600 1600 Small Business Business Tax Business Advice

Beware Those Fintech Small Business Loans Can Cost You Bigtime Mortgage Interest Rates Mortgage Loans Pay Off Mortgage Early

Form 8829 Instructions Your Complete Guide To Expense Your Home Office Zipbooks

Tax Deductions And Credits For Homeowners Tax Deductions Business Tax Deductions Homeowner Taxes

Five Ways Mortgage Tax Deduction Can Improve Your Business Mortgage Tax Deduction Https Ift Tt 36kzc4m Home Equity Loan Home Equity Equity

Publication 936 2018 Home Mortgage Interest Deductionfor Use In Preparing 2018 Returnspublication 936 Intro Mortgage Interest How To Find Out New Reminder

Rental Property Tax Deductions Mortgage Interest Tax Deductions Property Tax

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Is Any Loan Interest Tax Deductible Yes These Interests Are Deductible Some Fully Some Par Small Business Tax Deductions Business Tax Deductions Business Tax

Here S A Summary Of The Main Changes With The New Tax Law Passed Last Month Capital Gain Tax Deductions Home Ownership

Post a Comment for "Business Use Of Home Excess Mortgage Interest"