Nj Business Quarterly Taxes

Employers use the Form NJ-500 Monthly Remittance of Gross Income Tax Withheld to remit tax for either of the first two months of a quarter whenever the. Log in using your New Jersey tax identification number and business name.

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

You cant view information on past payments.

Nj business quarterly taxes. Enter your customer number and pin number. Log in using your New Jersey tax identification number and business name. If you are doing business in New Jersey you must register for tax purposes by completing Form NJ-REG at New Jerseys Online Business Registration.

Estimated Taxes Federal income tax is a pay-as-you-go tax. This option allows you to file the NJ927 form NJ-W-3 and pay withholding taxes only. Estimated Tax Payments.

File and Pay Taxes Only. There are two ways to pay as you go. How to Make an Estimated Payment.

You wont be able to submit the wage-reporting form WR30 or view past filings and payments. If you have losses in certain business-related categories of income you may be able to use those losses to calculate an adjustment to your taxable income Alternative Business Calculation AdjustmentIn addition you can carry forward unused losses in those categories for 20 years to calculate future. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Broadly speaking the AMA based on gross profits and the AMA based on gross receipts apply only to multistate corporations whose business presence in New Jersey is limited to soliciting orders. Attention Boat and Vessel Sellers. The identification number used for the business is usually the federal identification number FEIN.

Employers not classified as weekly payers must report and remit tax on a monthly or quarterly basis. Business Taxes The form of business you operate determines what taxes you must pay and how you pay them. This option allows you to file and pay taxes only.

Pass-Through Business Alternative Income Tax Act PTE Forms Due to technical difficulties the due dates for the PTE Election and PTE-200-T Extension of Time to File forms have been extended to June 15 2021. This option allows you to file extensions and pay taxes only. For more about New Jersey sales tax check out the New Jersey section of the TaxJar blog.

How to complete a tax return online. Quarterly Employer Report of Wages Paid WR-30 File or Pay Online. This option allows you to file and pay taxes only.

Entire net income greater than 100000 9 tax rate. The new entity-level tax is referred to as a pass-through business alternative income tax that is effective as of January 1 2020. NJ Income Tax - Business Income.

Estimated tax is the amount of Income Tax you estimate you will owe for 2021 after subtracting withholdings and other credits. NJ Income Tax - Business Income. In New Jersey you will be required to file and remit sales tax either monthly or quarterly.

Log in using your New Jersey tax identification number and business name. Now that sales tax is out of the way you can get back to what you do best running your business. Due to Covid-19 Tax Year 2020 due dates were changed to June 15 2020 July 15 2020 September 16 2020 and January 15 2021.

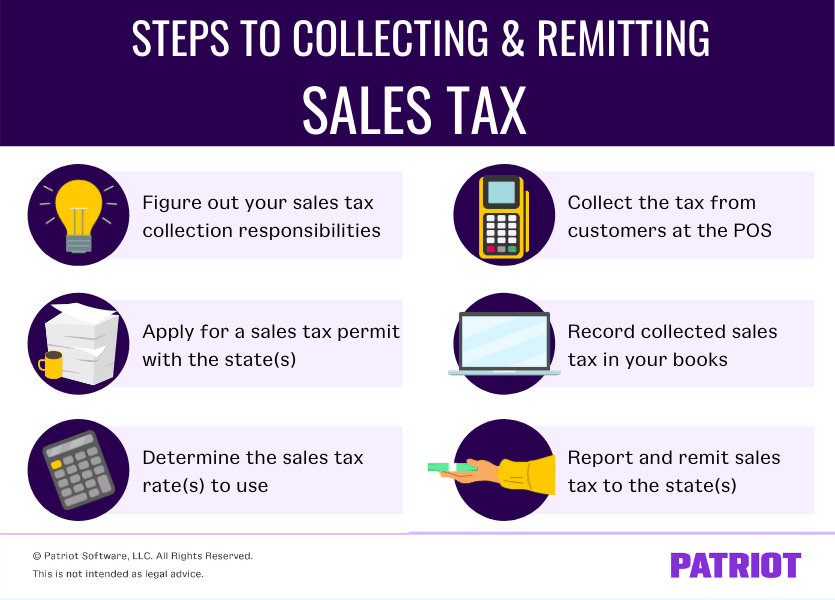

Sales and Use TaxSalem Sales and Use Tax. How often you need to file depends upon the total amount of sales tax your business collects. Registering for Tax Purposes.

Farmers and fiscal year filers see the instructions for Form NJ-1040-ES for information on due dates. New Jersey Sales Tax Resources. Use the Estimated Tax Worksheet in the NJ-1040-ES instructions to estimate your income and tax.

Employment Taxes for Small Businesses. File New Jersey payroll tax returns and pay withholding taxes without seeing wage reporting or historical data. This can be found on your most recent statement from the NJMVC Click IFTA tab at the top.

You must pay the tax as you earn or receive income during the year. Jersey sales tax filing. Click Quarterly Tax Return click submit.

Enter reporting period information click submit twice. QuarterlyMonthly Return ST-50ST-51ST-450ST451ST-50B450B Information About The New Sales Tax Partial Exemption and Cap Effective February 1 2016. You cant view information on past filings and payments.

To obtain a PIN you will be asked to supply identifying information from previous business tax filings. File Extensions and Pay Taxes Only. File and Pay Taxes Only.

To obtain a PIN you will be asked to supply identifying information from previous business tax filings. In effect this provides business owners a deduction for their New Jersey taxes without those taxes being subject to the 10000 cap. Withholding and estimated taxes.

You cant view information on past filings and payments. To obtain a PIN you will be asked to supply identifying information from previous business tax filings. If your business collects less than 50000 in sales tax per month then your business should elect to file returns on a quarterly basis.

Small Business Tax Rates For 2020 S Corp C Corp Llc

How Is Tax Liability Calculated Common Tax Questions Answered

How To Pay Quarterly Taxes If You Re A Business Owner

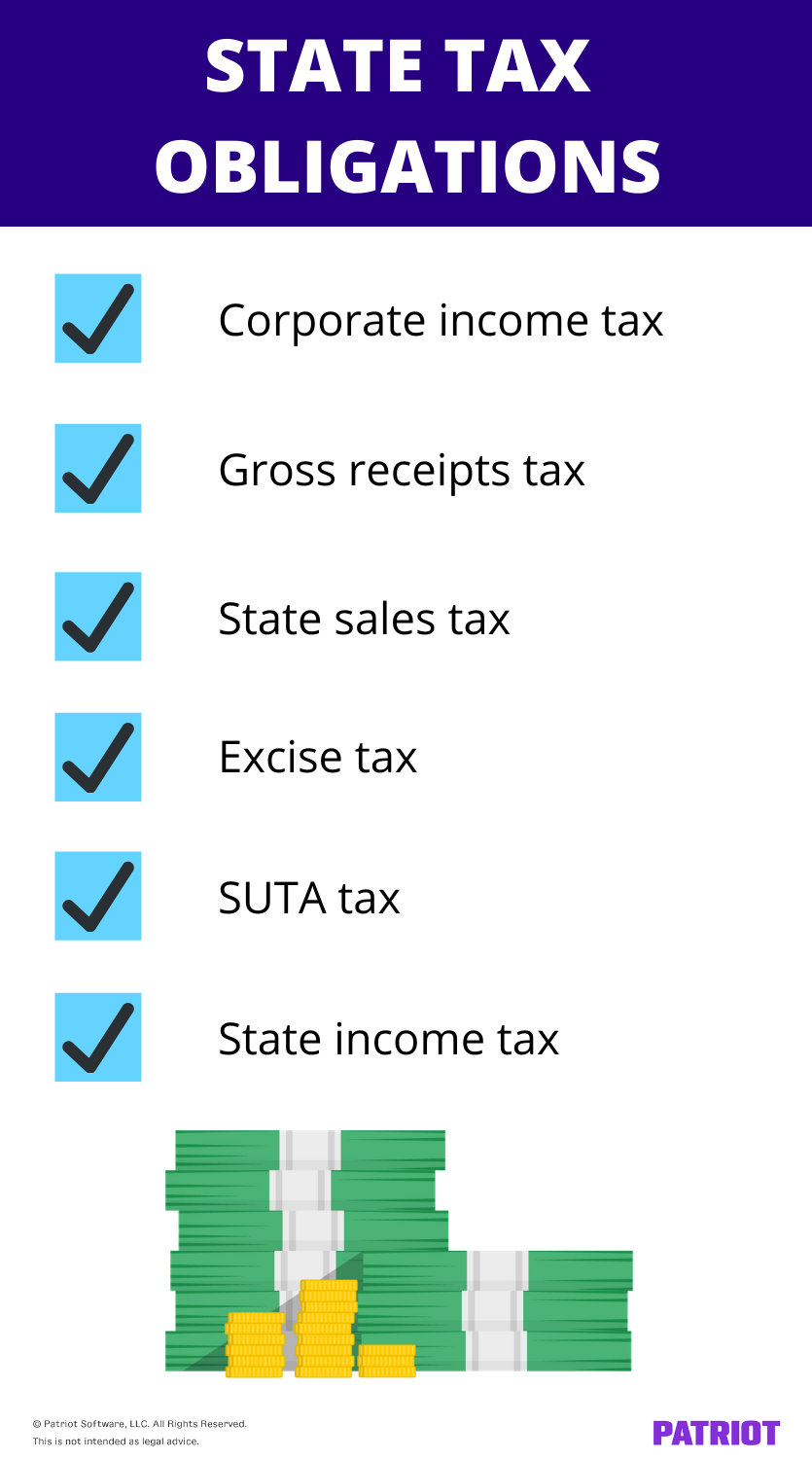

Business State Tax Obligations 6 Types Of State Taxes

How To Pay Quarterly Taxes If You Re A Business Owner

Corporation Business Tax Login

Tax Services Tax Services Business Tax Accounting Services

How To Choose Between Bonds Cds And Savings Accounts Family Money Saving Business Tax Economy Infographic

How Much Does A Small Business Pay In Taxes

2020 New Jersey Payroll Tax Rates Abacus Payroll

How Is Tax Liability Calculated Common Tax Questions Answered

Business Tax Timeline Annual Vs Quarterly Filing Synovus

How To Pay Sales Tax For Small Business 6 Step Guide Chart

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

Iberahim Hadijah 2013 Vertical Integration Into Global Value Chains And Its Effects On Skill Development I Vertical Integration Skills Development Skills

2019 2020 Tax Guide Tax Guide Financial Advice Tax Help

Which Business Entity Is Right For You Financial Services Business Ownership Investing

How To Pay Quarterly Taxes If You Re A Business Owner

New Jersey Business Sales Taxes Incfile Com

Post a Comment for "Nj Business Quarterly Taxes"