Business Tax Id Check

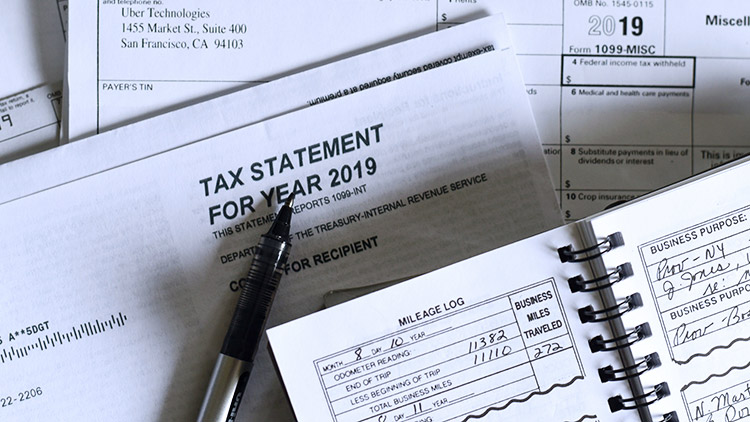

Check your email for the email confirmation from the IRS confirming your application and receipt of your tax ID number EIN If youve used your EIN when opening a bank. If you cant find those see if you can locate any legal or financial papers related to your business such as loan applications permits certifications or any documents that your EIN would likely be printed on.

Licensing Information Department Of Taxation

Legally you are required to identify your business with one of two numbers.

Business tax id check. When a business changes its structure it will usually be issued a new ID number. Check your tax documents You can find the number on the top right corner of your business tax return. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately.

Second check your prior tax returns loan applications permits or. It works in the same way as a Social Security number does for individuals and almost every business needs one. Updated March 25 2021.

This option is only available to authorized persons such as the owner of a business a trustee of a trust individuals with power of. Business Name- The current name of the business as it appears on our records. Find tax information and tools for businesses including Employer ID Number EIN Employment Tax Estimated Tax and the Foreign Account Tax Compliance Act FATCA.

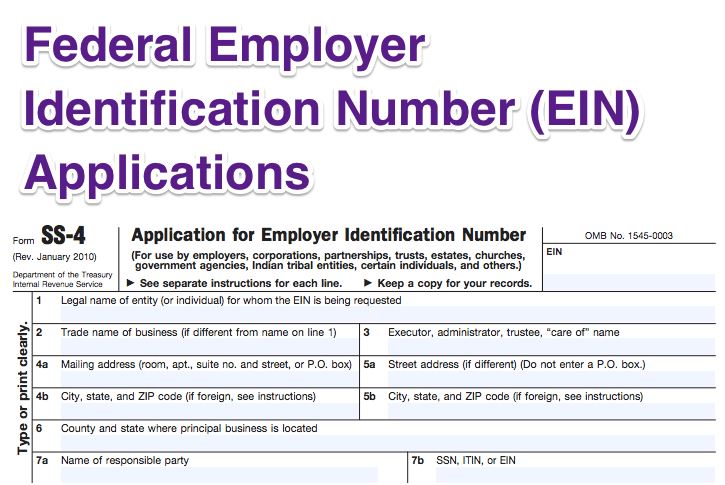

You may apply for an EIN in various ways and now you may apply online. The first place to check is your previous tax returns. An Employer ID Number EIN is an important tax identifier for your business.

Tax identification numbers are issued to businesses by the IRS depending on their structure. Either your social security number or an employer identification number. Help Business Name Search Glossary of Terms.

Check your Experian business credit report to stay in control of your business credit. Another wild card is the underscore _ character when used within a word. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

The most important reason for an EIN is to identify your business for federal income tax purposes but its also used to apply for business bank accounts loans or credit cards and for state and local taxes licenses and other registrations like sales tax or a local business. An EIN is one type of tax ID the Internal Revenue Service issues to businesses. First check to see if you received an email or physical letter from the IRS confirming your EIN when you first applied.

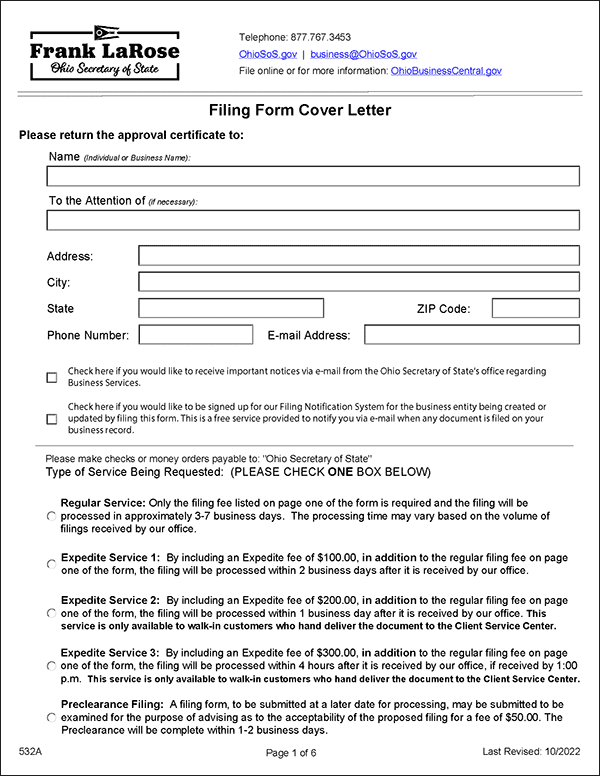

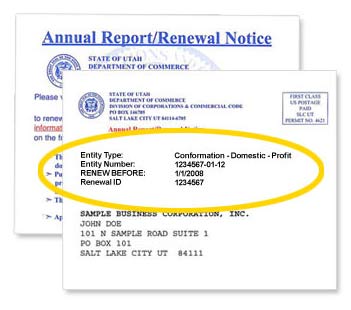

The underscore character will match any single character that you enter it for. Entity Number The entity number is a unique identifier assigned to a business by the Ohio Secretary of State. It will be in either your email or in a letter depending on how you applied.

Here are several ways you can look up your employer identification number. If you are a foreign corporation give Ohio certificate number. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

It impacts your business in numerous ways such as the amount of credit suppliers will extend you and the interest rates youll pay. Like an individuals social security number this nine-digit number helps the IRS identify and track payments to businesses with employees including. If you file under cumulative return authority what is your master number.

Your business credit score is essential to the financial health of your business. Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax employer withholding commercial activity tax unclaimed funds and unemployment compensation tax. For example c_t will return names containing cat.

Use the 11-digit Comptrollers Taxpayer Number or the 9-digit Federal Employers Identification Number. A business tax ID number also called an employer identification number EIN or federal tax ID is a unique nine-digit number that identifies your business with the IRS. Generally businesses need an EIN.

The search will find all business entities in the records that contain COLUMBUS and the next significant word that started with CONTRACT. Check With the IRS In case you dont remember your EIN you may call the IRS Business Specialty Tax Line at 800-829-4933. Owners of most types of.

Check type of ownership. A federal tax ID lookup is a method of searching for a businesss information using their tax identification number FTIN or employer identification number EIN. 10 Sole owner F 20 Partnership F 30 Corporation F 40 Association F 50 LLC F 60 Fiduciary F 70 LLP F 80 LTD F 100 Business.

It is a Charter Number for Domestic Corporations. If you open the return and discover that the. Generally businesses need an EIN.

Letter Ein Confirmation Confirmation Letter Employer Identification Number Doctors Note Template

Your Ein Confirmation Letter Irs Form Cp 575 Harvard Business Services

Learn How To Fill Out A W 9 Form Correctly And Completely

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

What Are The Dangers Of Giving Out Your Ein

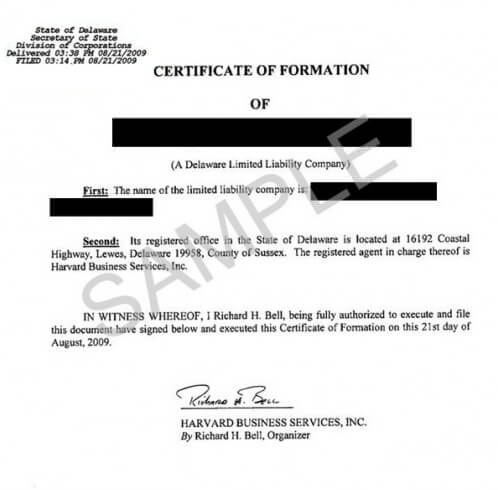

Delaware State File Number What It Is How It S Used Harvard Business Services

Is My Tax Id The Same As My Social

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Letter Of Employment

Llc Ohio How To Start An Llc In Ohio Truic

How To Fill Out A W 9 For A Nonprofit Corporation Legalzoom Com

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

What Is An Fein Federal Ein Fein Number Guide Business Help Center

Change Your Business Name With The Irs Harvard Business Services

How To Get A Sales Tax Exemption Certificate In Wisconsin Startingyourbusiness Com

Online No Tax Due System Information

Online No Tax Due System Information

What Is A W 9 Tax Form H R Block

How To Find A California Tax Id Number Ein Legalzoom Com

Post a Comment for "Business Tax Id Check"