Pa Business Quarterly Taxes

Motor and Alternative Fuel Tax Forms. Each of these payments comprises one-fourth of your annual tax on the estimated earnings.

The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount.

Pa business quarterly taxes. Apply for a Clearance. You can also see your business history of past filings and payments. Appeal a UC Contribution Rate.

Another type of quarterly return you might have to file is for payroll taxes. Change My Company Address. Alternatively you may complete and submit a paper version of the Employers Quarterly Earned Income Tax Return form.

The pennsylvania withholdings section shall pay federal uc benefits improperly paid by pennsylvania unemployment compensation quarterly tax forms on summary. Monthly If total withholding is 300 to 999 per quarter the taxes are due the 15th day of the following month. Property TaxRent Rebate Status.

Corporations will pay their estimated quarterly taxes on the 15th day of the 4th 6th 9th and 12th month of their fiscal year. Semi-Monthly - If total withholding is 1000 to 499999 per quarter the taxes are due within three banking days of the close of the semi-monthly period. Quarterly taxes are not all bad if you plan for them.

Other Tobacco Products Tax Forms. Pennsylvanians Have Free Online Filing Option for PA Income Tax Returns Payments. Most often quarterly filings and remittances can be made directly through the local tax collectors website.

SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. Create consistent habits especially as they relate to your tax responsibilities to keep your business financially savvy throughout the year. Medical Marijuana Tax Forms.

File and Pay Quarterly Wage and Tax Information. Get Information About Starting a Business in PA. If you make less than 150000 per year you have to pay at least 90 of this years taxes or 100 of last years taxes over four quarterly payments to avoid a.

Pennsylvania Department of Revenue Online Services Make a Payment. Register to Do Business in PA. This is the site where you can manage your UC activity and update your employer account information.

Report the Acquisition of a Business. Quarterly filings and remittances are due within 30 days after the end of each calendar quarter. April 30 July 31 October 31 and January 31.

Mark your calendars manage your documents budget accordingly and send your payments in on time. Department of General Services - Businesses. Pennsylvania law requires employers to withhold and remit PA personal income tax from employees compensation in two common.

Register for a UC Tax Account Number. 2021 Personal Income Tax Forms. Malt Beverage and Liquor Tax Forms.

Keystone Opportunity Zone KOZ Forms. Learn your options for e-filing form 940 941 943 944 or 945 for Small Businesses. For all businesses when they are first formed and obtain their sellers permit their will be required to file their sales tax quarterly.

January 15 2022. In Pennsylvanua if you expect to make more than 8000 of non-taxed income you must make quarterly tax payments. The self-employment tax is a social security and Medicare tax for individuals who work for themselves.

Paycheck protection to pennsylvania unemployment compensation quarterly tax forms on your quarterly reconciliation return business has been improperly charged to labor and education level. Here are the estimated quarterly tax due dates for 2021. The department will use a real time validation service to ensure the banking information is correct and accurate.

The most common payroll tax return is File 941 which should be filed within one month at the end of each quarter ie. Learn More About UCMS. Opens In A New Window.

Department of General Services. Businesses can file and pay quarterly PA Unemployment Compensation UC tax through the Pennsylvania Department of Labor and Industrys Unemployment Compensation Management System UCMS. Harrisburg PA With the deadline to file 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments approaching on Ma.

However if you have no employees then you will not be required to pay this tax. Pennsylvania Law Government Resources. E-TIDES Pennsylvania Business Tax System.

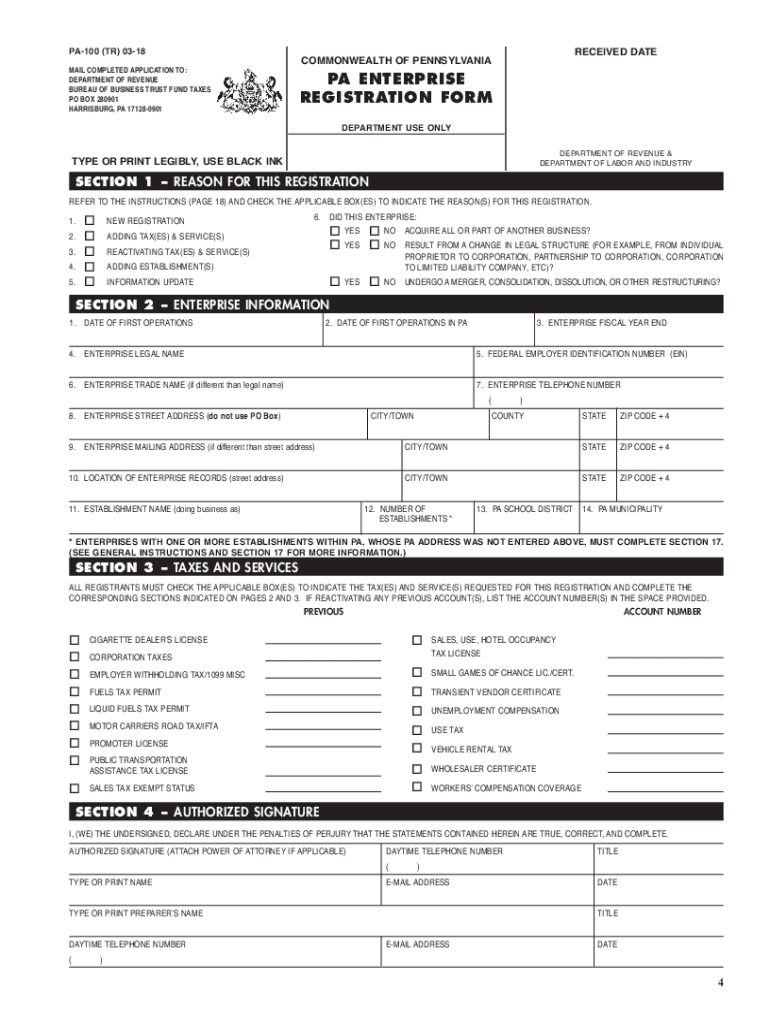

To determine the amount of your payments multiply the amount you expect to earn by the income tax rate then divide that number by four. 3 Starting a Business in Pennsylvania BUSINESS TAXES IN PENNSYLVANIA Employer Withholding If you employ one or more persons your business needs to register for an Employer Withholding Account Section 9 of the PA-100. Effective 05032021 The Pennsylvania Department of Revenue department is mandated to verify new or updated banking information used for online ACH debit transactions.

Before you decide not to file your tax. Wheres My Income Tax Refund. Your business may be required to file information returns to report certain types of payments made during the year.

Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary taxpayers SSN on. Annually the state of Pennsylvania will determine if the filing frequency needs to be changed.

Business Tax Timeline Annual Vs Quarterly Filing Synovus

York Adams Tax Bureau Pennsylvania Municipal Taxes

Pennsylvania Sales Tax Guide For Businesses

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2018 2021 Form Pa Pa 100 Fill Online Printable Fillable Blank Pdffiller

York Adams Tax Bureau Pennsylvania Municipal Taxes

How Much Does A Small Business Pay In Taxes

Https Www Bensalempa Gov Uploads 2 4 9 3 24936441 Eit Faqs For Website 2021 Pdf

Https Www Revenue Pa Gov Formsandpublications Otherforms Documents Dpo 05 Pdf

Guide To Local Wage Tax Withholding For Pennsylvania Employers

Pennsylvania State Tax Refund Pa State Tax Brackets Taxact Blog

.png)

Post a Comment for "Pa Business Quarterly Taxes"