What Is The Ohio Municipal Net Profit Tax

MUNICIPAL NET PROFIT TAX FILING DEADLINE REMINDER PDF. The first day of the third month of the taxable year is the deadline for the notification.

Https Tax Ohio Gov Portals 0 Muni Net Profit Instructionsfordeclarationofestimatedpayments Pdf

If the request is received by the tax administrator on or before the date the municipal income tax return is due the tax administrator shall grant the taxpayers requested extension.

What is the ohio municipal net profit tax. This request should be submitted using Form 20-EXT - Declaration of Estimated Municipal Income Tax on Net Profit andor Application for Extension of Time to File. Taxpayers who have opted in for centralized filing with the Department are required to file and pay the MNPT electronically via the Ohio Business Gateway at httpsgatewayohiogov or through Modernized e-File. Businesses can request a different apportionment with the state according to Ohio Revised Code 71882 B2.

312018 2 Background Philadelphia PA 1st Municipal Income Tax in US. This message is a reminder to all municipal net profit tax MNPT practitioners and taxpayers that the return for taxpayers with a February fiscal year-end is due June 15 2021. This message is a reminder to all municipal net profit tax practitioners and calendar year taxpayers that the second declaration and estimated payment for the 2021 tax year is due June 15 2021.

Municipal Net Profit Tax Estimated Payment Deadline Reminder. REGISTRATION ALERT MUNICIPAL NET PROFIT TAX PDF 09252020. Unifying the collection and administration of the net profits tax is a common sense first step toward a simpler municipal income tax system more in line with the rest of the country.

The Net Profit tax is also a municipal income tax. On August 30 th 2018 The Revenue Accounting Division hosted a webinar intended for use by municipalities seeking more information regarding the newly enacted Municipal Net Profit Tax. Ohio Municipal Net Profit Tax MNP General Instructions and Information for Taxpayers The enactment of Amended Substitute House Bill 49 132nd General Assembly provides business taxpayers the option beginning with the 2018 tax year to file one municipal net profit tax return through the Ohio Business Gateway for processing by.

Municipal net profit taxes make up about 15 of total municipal tax revenue. Tax rates and credits are left to the cities and access to taxpayer information collected by ODT is still available to the cities. The constitution allows state lawmakers to enact a set of rules governing how to assess collect and distribute the business income taxes which are known as net-profits.

Topics covered in the webinar included general information regarding the tax a detailed description of the distribution process an explanation of the monthly distribution reports and commonly asked questions. Effective October 2 2020 the Cincinnati Income Tax Rate is 18. Penalty Unpaid Tax.

This is the tax on the income earned by the business in the municipality. The approval of the Hamilton County sales and use tax levy to provide general revenues for the Southwest Ohio Regional Transit Authority eliminated the 3 Transit earnings tax. Cincinnati Earnings Tax Rate Reduced to 18 on October 2 2020.

MUNICIPAL NET PROFIT TAX FILING DEADLINE REMINDER PDF 06032021. Donnelly stated that the municipalities have the power under home rule to levy income taxes but that two other provisions in the Ohio Constitution authorize the Ohio General Assembly to limit local taxation. Welcome to Ohios Regional Income Tax Agency RITA with a website designed to make your municipal tax administration service more easily accessible and navigable online.

1938-39 Toledo 1st Ohio municipality to enact income tax 1946 Ohio cities and villages begin to adopt income tax Late 1960sEarly 1970s Background The municipal income tax applies to Individuals who. A penalty may be imposed on unpaid income tax including unpaid estimated tax equal to 15 of the amount not timely paid. SS1 Pre-2017 net operating.

Under the changes made by the budget bill a business may elect to have the Ohio Department of Taxation the Department administer the business municipal net profit taxmeaning the business may choose to file a single return with the Department that covers the business total tax liability to all municipal corporations. Writing for the majority Justice Michael P. With forms tools and communication strategies that simplify and increase transparency we are helping individuals businesses and tax professionals navigate the.

The State of Ohio is requiring electronic filing of municipal net profit tax returns for all businesses that have opted- in. The bulk of all other city tax revenue is still administered by the cities individual income tax employer withholding etc. The amount of net operating loss carry forward that may be utilized is limited to the lesser of 50 of the carried forward loss or 50 of that years income.

Earn taxable income in one or more Ohio municipalities and. For pre-2017 losses see Special Notes For Tax Years 2015 and Prior. RR Qualified municipal corporation means a municipal corporation that by resolution or ordinance adopted on or before December 31 2011 adopted Ohio adjusted gross income as defined by section 574701 of the Revised Code as the income subject to tax for the purposes of imposing a municipal income tax.

As a result of legislation passed by the Ohio General Assembly penalty and interest rates for Ohio municipal income tax for years beginning on or after January l 2016 will be as stated below. Ohio Department of Taxation is excited to announce a new feature Online Notice Response Service PDF. This tax is reported annually on the Form 27 Net Profits Tax Return.

In addition to filing the Form 27 the business is required to make quarterly estimated tax payments. It would promote a system where Ohio businesses arent put at a competitive disadvantage and can focus on creating value as opposed to complying with tax laws. Losses incurred in tax years 2017 through 2021 are subject to a 50 phase-in limitation.

Https Www Tax Ohio Gov Portals 0 Forms Municipal Net Profit 2019 Mnp Municipal Net Profit Tax Municipality Notification For Taxpayers Pdf

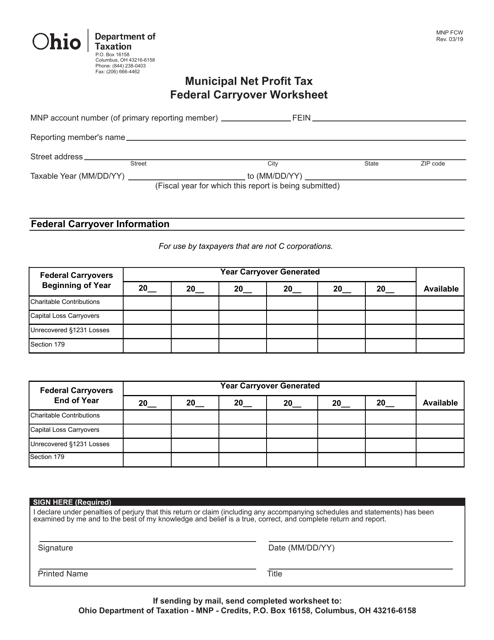

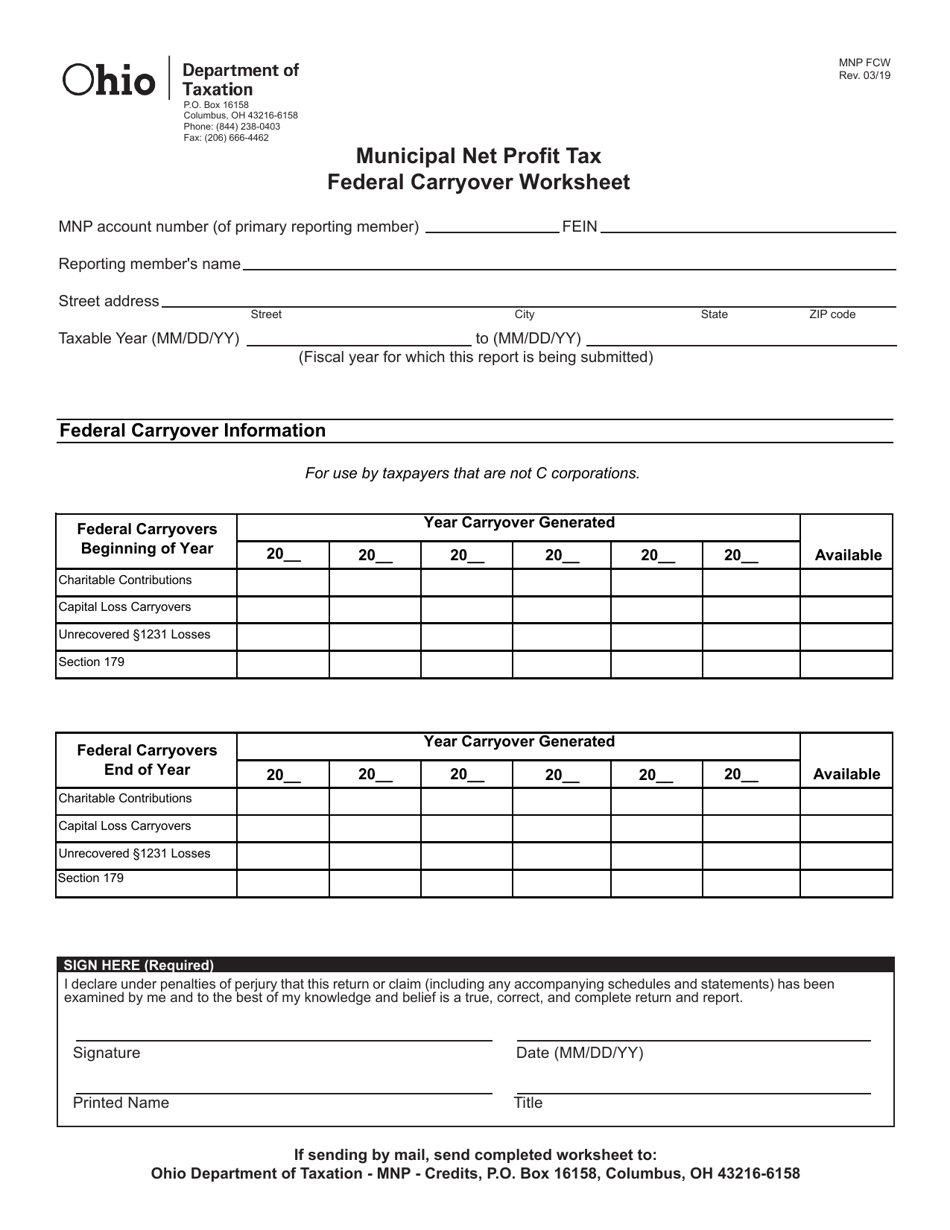

Form Mnp Fcw Download Printable Pdf Or Fill Online Municipal Net Profit Tax Federal Carryover Worksheet Ohio Templateroller

Municipal Net Profit Tax Department Of Taxation

Form Mnp Fcw Download Printable Pdf Or Fill Online Municipal Net Profit Tax Federal Carryover Worksheet Ohio Templateroller

Municipal Net Profit Taxpayers Department Of Taxation

Form Mnp Nol Dw Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Net Operating Loss Deduction Worksheet Ohio Templateroller

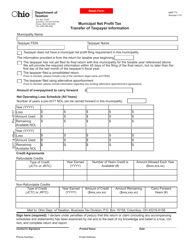

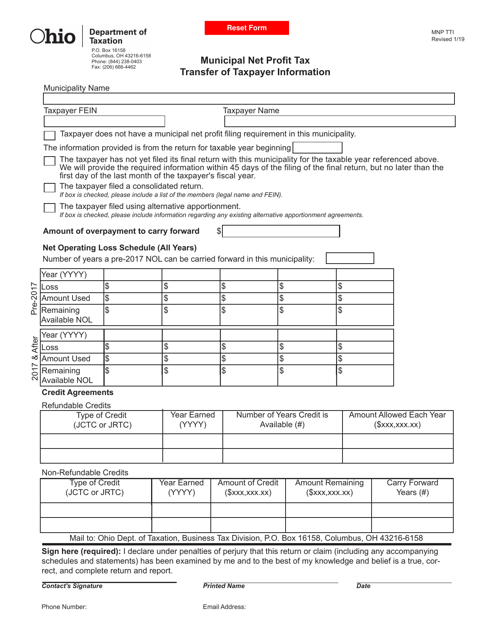

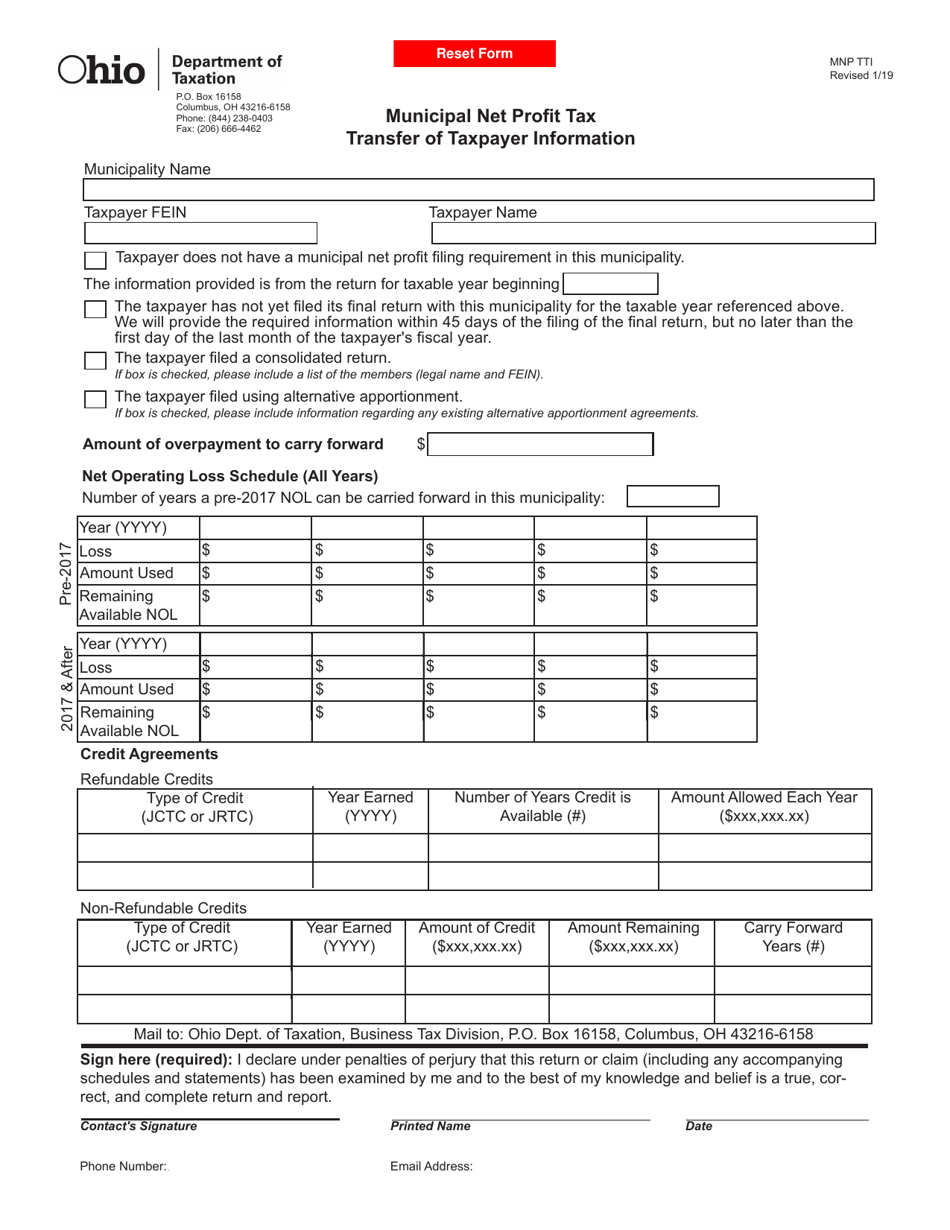

Form Mnp Tti Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Transfer Of Taxpayer Information Ohio Templateroller

Https Cdn Ritaohio Com Media 700762 Greater 20ohio 20association 20of 20tax 20administrators 20post 20on 20website 202019 Pdf

Ohio Mnp 10 Tax Ohio Gov Ohio Mnp 10 Tax Ohio Gov Pdf Pdf4pro

Https Cdn Ritaohio Com Media 701055 Pdf 20tax 20preparer 20webcast 202020 Post 20on 20website Pdf

Ohio Mnp 10 Tax Ohio Gov Ohio Mnp 10 Tax Ohio Gov Pdf Pdf4pro

Ohio Tax Gateway Ohio Business Gateway Sales Tax

Form Mnp Tti Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Transfer Of Taxpayer Information Ohio Templateroller

Https Cdn Ritaohio Com Media 701055 Pdf 20tax 20preparer 20webcast 202020 Post 20on 20website Pdf

Https Tax Ohio Gov Portals 0 Muni Net Profit Instructionsfordeclarationofestimatedpayments Pdf

Https Tax Ohio Gov Portals 0 Muni Net Profit Instructionsfordeclarationofestimatedpayments Pdf

Https Tax Ohio Gov Portals 0 Muni Net Profit Instructionsfordeclarationofestimatedpayments Pdf

Https Www Clevelandheights Com Documentcenter View 465 2018 Form 27 Instructions Pdf Bidid

Form Mnp Tti Download Fillable Pdf Or Fill Online Municipal Net Profit Tax Transfer Of Taxpayer Information Ohio Templateroller

Post a Comment for "What Is The Ohio Municipal Net Profit Tax"